Dear Investor,

In this memo we will do a review of the Q3 results of our portfolio companies and will also share our take on the markets.

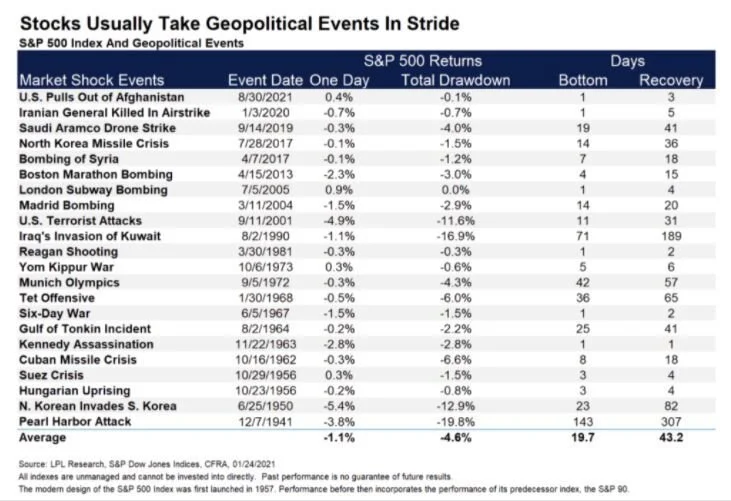

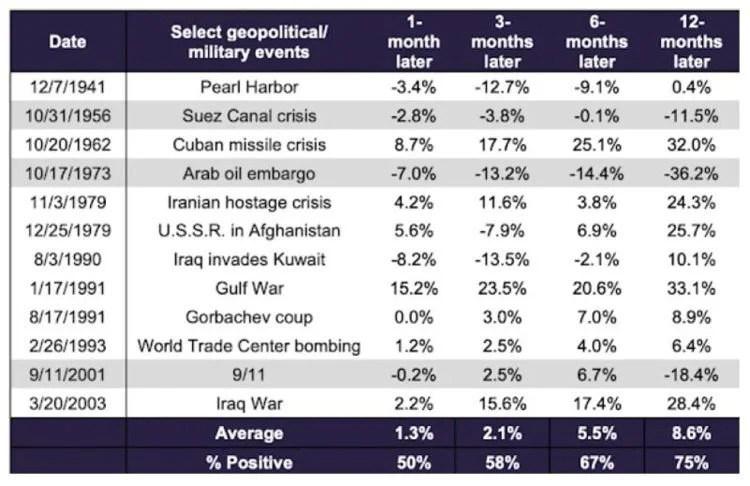

Equity markets globally have been challenging since October 2021 and equity returns have been very meagre in the last 1.5 years or so. We had communicated last year in March that any sort of correction is always a good time to increase allocation to equity because outsized returns can only be made when investing is initiated, or allocation is increased during a phase of market correction or consolidation. It has been almost a year since then and markets continue to be difficult with no visible respite in macro headwinds. The Russia-Ukraine war still goes on and can possibly turn uglier, inflation has cooled a bit but continues to be sticky and high still, central banks are still hiking rates and the possibility of any reversal with a rate cut is very remote now.

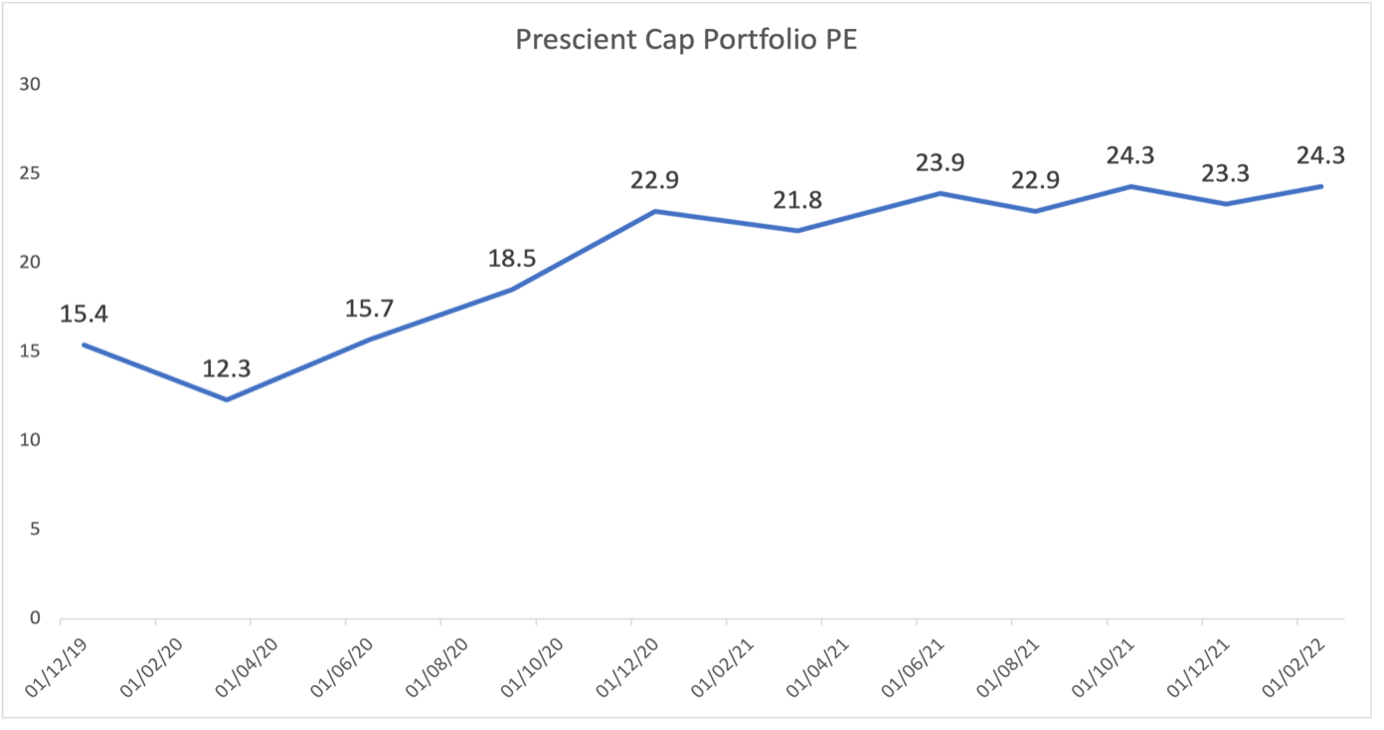

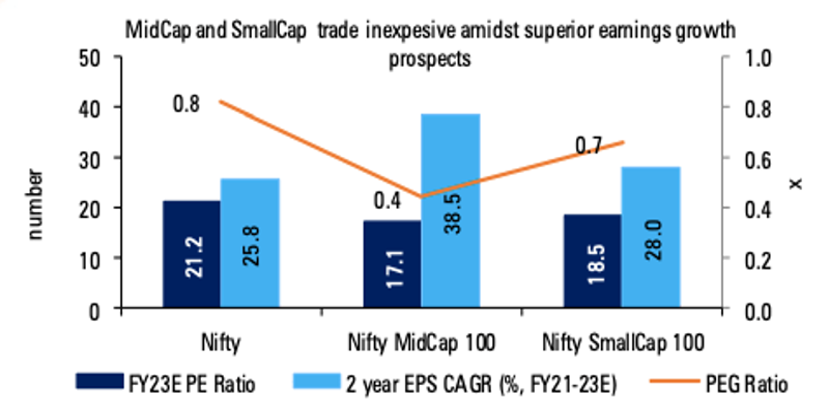

However, we will stick with our advice that markets currently are offering an attractive point to increase allocation. Valuations have turned quite attractive, and we are finding much better investment opportunities compared to the start of 2022. Even in our portfolio, there are several companies that have delivered strong growth (portfolio performance discussed below) but their share prices are either flat or even have fallen in the last 1.5 years or so. So, it makes sense to allocate more to equity now though we will be candid we have no clue of when there will be reversal in market trend or whether even the market has bottomed out. No one can time the market so there is no way to predict whether there will be further correction or the time frame in which markets will bounce back. But we are sure that when the market trend will reverse, the return from that point on will be significant. Equity returns do not come in a linear manner and the average long term ~13-14% CAGR of Indian indices have been delivered in a very volatile way if one looks closely at annual returns over the last 15-20 years.

So, we will repeat our advice of increasing your allocation to equities to take advantage of the current market mood. We expect markets to remain tough over the next few months as macro challenges persist, so it is better not to expect any quick returns from here on. However, to handle the volatility, a good approach can be to invest whatever amounts one can one in a SIP manner during this volatile phase. The incremental allocation does not have to come in a large lumpsum.

In this month’s update, we will be discussing the Q3FY23 (Oct-Dec 2022) and 9MFY23 (Apr-Dec 2022) performance of our portfolio. The table below shows the company wise performance. Depending on different factors like vintage of portfolio, valuations at which the portfolio companies were trading at, cash in portfolio, etc, different client portfolios will have different compositions.

Some highlights of the portfolio performance are:

In 9MFY23, the median sales growth (yoy) and EPS growth of the portfolio companies were 23% and 15% respectively. In the latest quarter, i.e. Q3FY23, the corresponding figures were 17% and 19% respectively.

The profit growth in 9MFY23 was substantially lower than sales growth due to inflation in commodity & energy prices, freight rates, etc as well as other supply bottlenecks like chip shortages in the auto sector. However, inflation seems to be subsiding as most portfolio companies reported improved profitability sequentially as is visible in higher profit growth than sales growth in Q3FY23.

The median P/E (ttm) and P/B (ttm) of the portfolio were 17.3 and 9.9 respectively. Our portfolio is trading cheaper at a 16% discount to the Nifty 500 index, which is trading at a P/E of 21.25.

The balance sheet of our portfolio companies is very healthy with 13 out of 18 Non BFSI portfolio companies having net cash on books.

We continue to be bullish about selective sectors that we believe will continue to deliver strong growth despite macro challenges like:

Capital goods & engineering companies with globally competitive products

Auto ancillaries that are making products for the EV space

Cement companies with industry leading cost competitiveness

Regional consumer plays that are increasing their distribution foot prints

Pharma companies with market leading Indian drug brands

Banks / NBFCs with razor sharp focus on asset quality and creating a strong liability franchise

The key point we want to emphasise is that the portfolio performance in Q3FY23 was above our expectations for the majority of the companies. There were a few disappointments mainly Heranba Industries and Mangalam Cement that delivered poor results due to sectoral headwinds and company specific challenges. However, overall, the portfolio performance is satisfactory, and the portfolio is quite healthy with most companies having net cash on balance sheet and strong growth outlook.

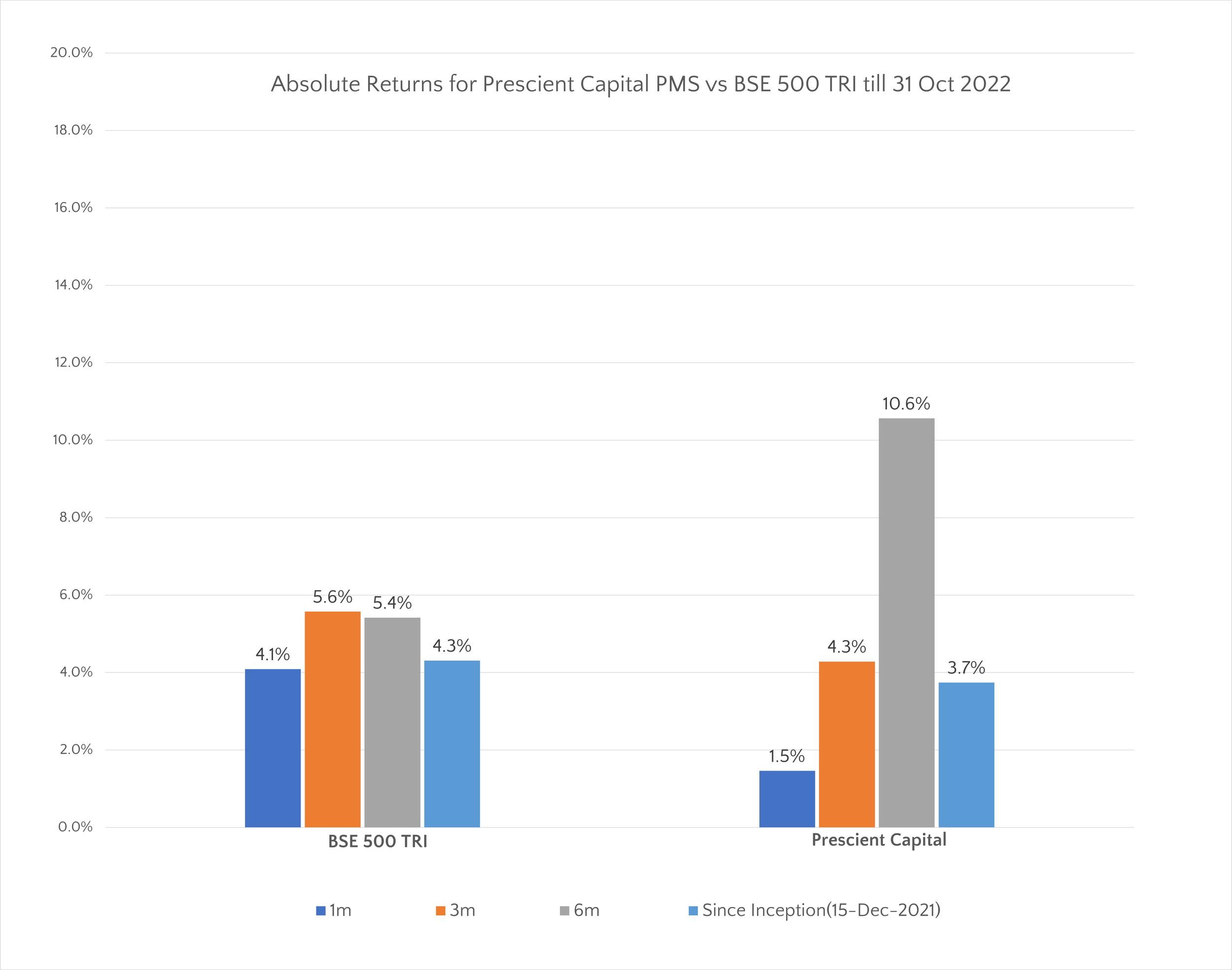

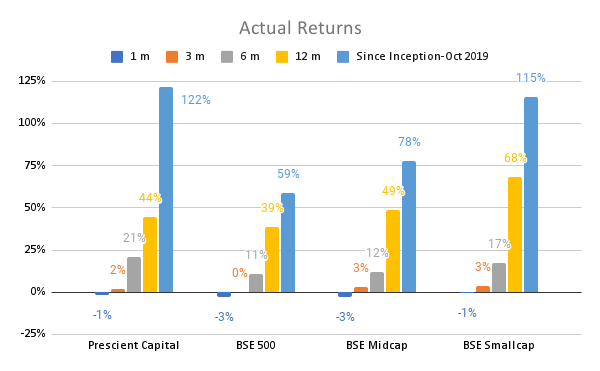

The market has been challenging since the start of 2022. We experienced that even those portfolio companies that beat expectation by a large margin in Q3FY23 did not witness any share price appreciation. While those companies that even slightly underperformed expectations have been punished severely. This is true not only for our portfolio companies but for the broader market in general and especially for small and mid-cap companies. The chart below compares our returns viz BSE 500 TRI index.

*This is a time weighted return for the overall PMS capital pool net of all fees and charges. This is not the return for a particular client.

The markets can continue to remain challenging given most of the macros are negative whether it is inflation not subsiding as much as expected globally, possibility of higher than expected hikes in interest rates, Russia Ukraine war escalating further, etc. It is impossible for us to predict market direction and macros so we will remain focused on bottoms up factors like earnings performance, growth outlook, valuation and balance sheet strength of our portfolio companies.

This is not to say that we will not be mindful of downward risks but that we will manage those by turning more conservative about valuations and by more stringent tracking of any challenges that our portfolio companies can face. We cannot predict when the markets will enter an upcycle, but our best efforts will be to minimise drawdown till we reach that stage. We will request you to remain patient through this difficult phase as you have been for the last year or so.

Please feel free to reach out if you have any questions or concerns.

Thanks & Regards

Prescient Capital