Dear Investor,

Below is a chart detailing our model portfolio returns viz the leading indices.

In this monthly memo we intend to discuss two broad topics:

Impact of Chinese real estate debt situation on India

Macro indicators relevant for investing for the medium/long term in India.

Impact of Chinese real estate debt situation on India

Real estate contributes to 25-30% of Chinese GDP. The recent clampdown by Chinese Community Party (CCP) on the home prices has sent the already levered balance sheets of Chinese real estate developers in a tailspin. Evergrande is just the beginning, the impact is systemic (stress up to 3-4% of GDP of China) and 10-15 large real estate companies are likely to face a cash flow crunch. Interestingly the first order impact of this debt crisis has been rather limited as a large part of the borrowing of these companies is domestic (>97% of borrowing of Evergrande is from Chinese Banks). What may be of interest from the overall slowdown of the real estate sector is the impact the same can have on the commodity prices. The Chinese real estate sector contributes ~25% of the global demand for iron and steel. The recent credit crunch may taper the demand and may soften the prices of Iron/Steel which have risen by >50% in the last one year. The Iron Ore price, which is a leading indicator of the future Steel price, has already sharply corrected by ~ 40% since July 2021. This may be good news for Indian engineering/manufacturing companies that have seen their margins getting eroded in the last 6 months.

The Indian real estate market has no correlation whatsoever with the Chinese real estate debt crisis. After the second COVID wave, the rebound in the Indian real estate market has been phenomenal. For the 9 M of FY22, the residential units sold are up YOY by 65% and the developers have also been able to pass on marginal price rise (1-4%). The overall demand is still hovering around 65-70% of the pre-COVID times though. Our discussions with managements of building material companies also indicate a strong rebound in demand. We typically don’t invest in real estate companies due to their poorly managed balance sheets and low returns on capital employed. We however like its derivative consumer facing businesses: building material and consumer durables. We have invested in SHIL in your portfolios. We believe that new project sales (40% of the sales contribution of SHIL) and pent up demand for building materials and durables (like cooktops, chimneys) should help SHIL grow at a CAGR of 15-20% for the next 2 years.

Macro indicators relevant for investing for the medium/long term in India.

The regulatory risk around investing in China has increased post CCPs clampdown in real estate, ed-tech, media, and fin-tech. The same could help sustain the high FII capital flows seen by the Indian markets in the recent past.

Given where the market valuations are, our investors and prospective clients have rightfully asked us this question: “Is it the right time to invest and are we in a Bubble?” As discussed with you in the last few memos, we wanted to discuss the same with some historical empirical data. We have picked up a table from a very well written memo by a peer PMS (Sage One September 2021 memo) to highlight some points:

Source: SageOne Investor Memo September 2021.

Key observations from the above are:

Corporate India is in its prime financial health (better balance sheets and cash flow generation) in FY 21/22 when compared to the last 20 years. The Debt / Equity Ratio, an indicator of leverage on the balance sheet, is the lowest since FY 2000. To add to it, COVID has created a perfect supply/demand shock for a lot of sectors and hence improved working capital for the large/mid/small cap companies. This has helped companies accumulate significant cash. The Cash Flow from Ops/Profit After Tax (CFO/PAT) is a leading indicator of the same.

Based on this data, we believe that we are at the beginning of a long capex cycle whereby companies would add capacities by using leverage. One could also argue that the Debt/ Equity ratio has been reducing systematically since FY 01. We would agree to that. However, almost all the manufacturing/engineering/oil & gas/chemical/utility/intermediate products companies we know and are tracking are adding large capacities. We therefore remain optimistic about the prospects of growth of earnings from a 4-5 years perspective.

Source: BSE

On the flip side, refer to the chart above: The PE multiple of the BSE 500 index is still high (October 2021 PE of 29.9x) even after correction from its all-time high of 38.8x in Feb 2021. It is fair to argue that the multiple is already factoring in this growth in earnings in the next 2-3 years.

There are two main reasons why the current high multiples are holding up: 1.) The growth prospects of Corporate India over the next 4-5 years and 2.) the current low interest rates and high market liquidity. The G-Sec yields are a proxy for lending rates and are at an all-time low (of 6.2%). If we look at the last rally between FY 02-08, the bonds yields came down from ~ 10% to around 5.2%. This propelled capital infusion in the capital markets which returned an IRR of ~ 30% over the 6-year period. At present, RBI is comfortable with the inflation and has kept the policy rates intact. Events such as the slowdown of real estate in China, could help alleviate concerns around inflation and interest rate movement for a while.

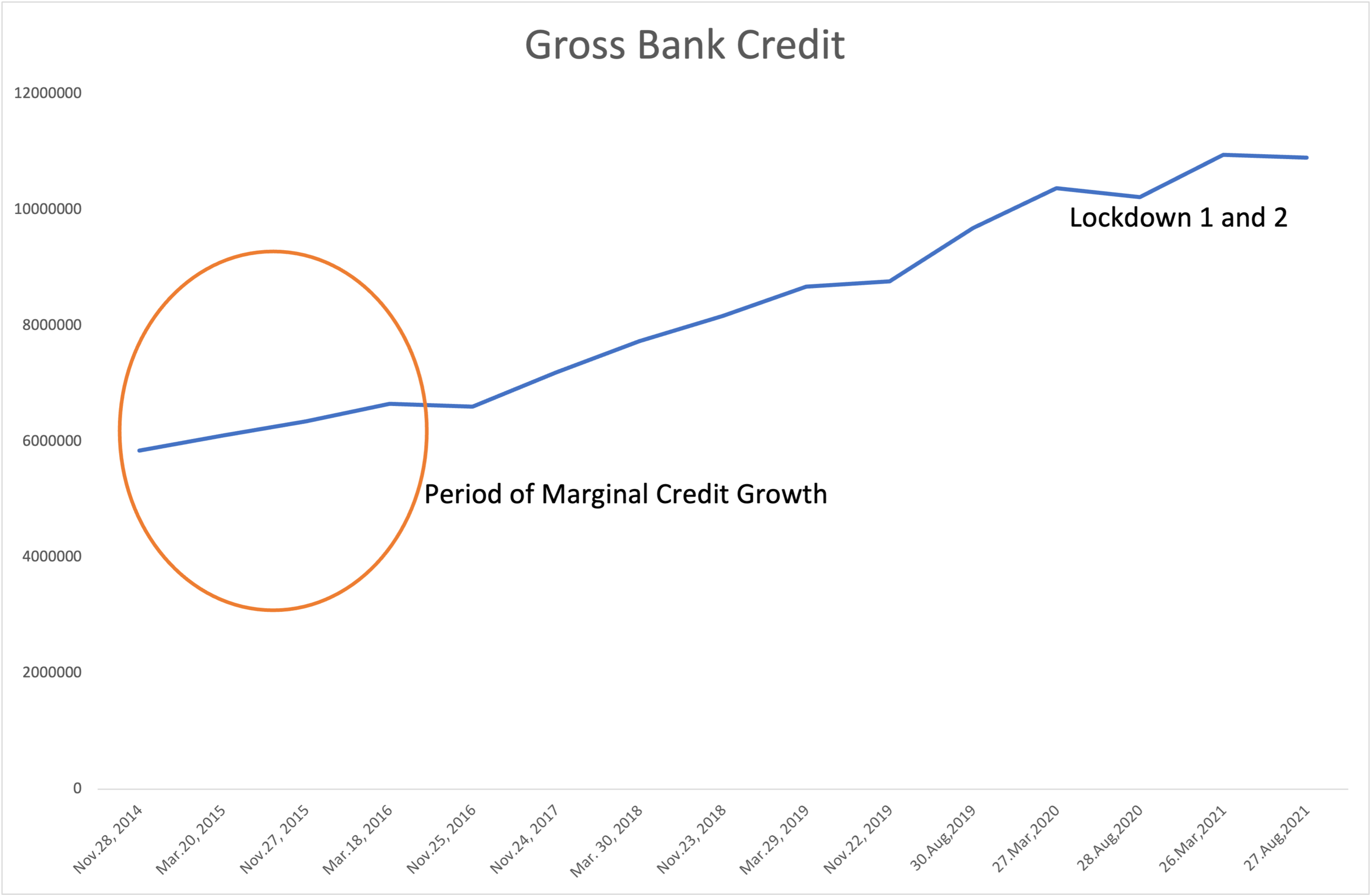

Worsening of the balance sheet quality of PSU/Pvt Banks could be a deterrent to the availability of leverage to corporate India. The same happened during the 2013-2016 period (refer charts below) during which the banking credit wasn’t available.

PSU Banks are the engine of corporate lending and from what we understand from their managements’ reports is that PSU Banks have sorted their asset quality concerns and are back to lending to corporates/SMEs. To our understanding, the overall banking sector has weathered the COVID lockdown well and their asset quality has been marginally impacted.

Source: BSE

Source: BSE

Given the background of A) Anticipation of high growth from Corporate India, B) Recovering credit markets, C) High valuation multiples, it is imperative that we continue to invest albeit conservatively. We are investing in companies where the trade-off between growth and valuation is not stacked against us. We would like to highlight the PE multiple of our model-portfolio viz the index.

It can be observed and commented upon that the gap between the index and our model portfolio valuations is narrowing over time. We attribute the same to two things:

The higher growth prospects offered by our portfolio viz the index has increased the valuation multiples of the portfolio companies. The valuations are still not at the alarming levels though.

We are at the cusp of exiting from a few companies that have done exceedingly well for us in the recent past however now look rich when we analyze from the framework of trade-off between growth and valuation. The portfolio’s PE multiple should ideally come down over the next 2-3 quarters as we exit these companies.

To summarize: We are safeguarding your returns by exiting companies in our portfolio that are at the peak percentile of their valuation multiples. We are redeploying the same capital gradually in new companies at fair/conservative valuation multiples. This will help us to tide well over this period of peaking markets.

The sectors where we are deploying capital at present are cement, building materials, auto ancillaries and banking services.

Prescient Capital

Contact us: https://www.prescientcap.com/contactform