Dear Investor,

Hope you are doing well.

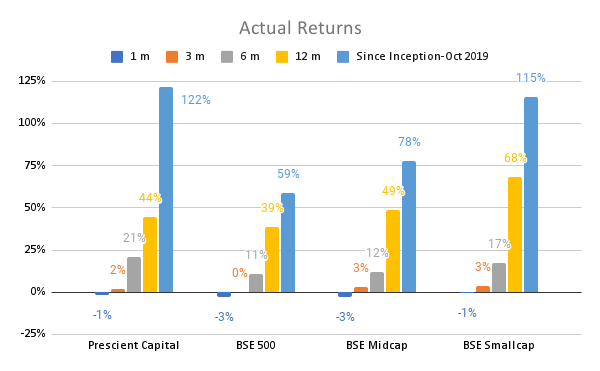

Below is a chart depicting our performance viz baseline indices:

As of Nov 30, 2021

In this monthly update we will try and summarize the performance of our portfolio companies in Q2 and H1 FY 22. The link to the summary table is as follows:

Key observations are:

Our portfolio has demonstrated a YoY sales and earnings growth of 21.6% and 12% respectively on a YoY basis for Q2 FY 22. The portfolio has demonstrated a YoY sales and earnings CAGR of 32% and 44% respectively in H1 FY 22.

It is apparent from the data that the portfolio has seen margin pressure in Q2 FY 22. The same is attributed to a near decade high prices of input commodities such as Steel, Coal, Palm Oil, and the like. The choke around global shipping lines also ensured that the freight costs were also at an all time high.

Compared to Q1 FY 22, ~ 50% our portfolio companies witnessed a reduction in EBITDA margin.

Margin pressure was minimum in:

IT/ITES services businesses due to a strong demand

Branded consumer goods/Branded pharma due to the company’s ability to pass on multiple price rises.

BFSI as interest rates harden and their book quality improves.

Margin pressure was maximum in intermediate chemicals and businesses with a low dependence on own manufacturing.

We would like to segregate the margin pressure in two categories: one where basic commodities are input. Second, where the input is not primarily a commodity but is dependent on a global supply chain.

The pressure on margins in the former is transient as we see steel (corrected by 25% from peak), palm oil (corrected by 10% from peak), Crude Oil (corrected by 20% from peak). We also see these businesses being able to pass cost inflation with a lag.

The pressure in margins for the latter where the inputs are linked to a global supply chain looks more long term and is not expected to improve in the next 1 year. Our checks with experts running global manufacturing setups indicate that the current covid driven lock downs in China, Europe and Asia are likely to affect the supplies for at least one year. We therefore are closely looking at the intermediate product makers companies in our portfolio and exiting them selectively (Granules).

At this moment we are confident that the margins of the companies in our portfolio will recover in the next 3-6 months. This confidence stems from a strong demand environment and a 5-6 year low inflation period in India. We believe that our portfolio companies have a strong MOAT (median ROE of ~ 20%) and can weather this high inflation environment.

We are seeing a strong demand in the following segments and are aligning our portfolio to the following themes:

Auto ancillaries serving the upcoming EV industry (FEIM, NRB).

Auto ancillaries serving the CNG commercial and passenger vehicles. The expansion of the CNG network in India is real and creating a trigger in demand for CNG driven PVs and CVs.

Banking sector has demonstrated resilience during COVID lockdowns. Demand for home loans, personal loans and corporate loans remains strong. We are investing in companies with a long term history of asset quality discipline and are available at the bottom percentile of the valuation. (Can Fin, IDFC F)

Domestic pharma has seen a strong demand post the second lockdown. The sector hasn’t run up in valuations. We are investing in branded pharma companies that specialize in chronic/acute segments. (Ajanta, JB, Alkem)

Consumer durables and building materials have seen a sustained strong demand. We are investing in companies that have a premium positioning and are backward integrated in mfg. (Hawkins)

During the last 2 months, we also exited/pruned our positions in the following companies as we think that the trade-off between growth and returns is not favourable.

Mphasis: Initiated entry at a PE of ~ 19-20x and exited at a PE of ~ 45x.

Birlasoft: Initiated entry at a PE of ~ 12-20x and exited at a PE of ~ 30x.

As a result of this churn in our portfolio, our portfolios median PE multiple has also reduced, refer below.

As we enter the new year, two main topics look noteworthy:

The global liquidity driven rally is at its fag end as inflation in developed world is making real returns negative. This is pushing regulators in these countries to increase bond yields. This is expected to lead to a drawdown of capital from equities to bonds. India still looks insular as GOI has controlled inflation well so far. Refer chart below:

Source: Charlie Bilello

Secondly, some of you have spoken with us on how we see investing in the short to medium term. Please refer to our September 2021 memo for reference.

Prescient Capital

Contact us: https://www.prescientcap.com/contactform