Dear Investor,

Wish you and your family a very happy, healthy and prosperous 2022.

Below is a chart depicting our portfolio returns viz BSE 500 TRI index.

As 2021 ended, we are sharing some interesting insights and data from 2021:

Indian equities as represented by benchmark index Nifty 50 have delivered an annual positive return in 20 out of the last 28 years (71% probability of positive return in a year). So, the odds of positive returns are quite healthy entering any given year. On the other hand, the longest streak of positive return years is 6. So for 2022 to be a positive return year, it will have to break a historical record as last 6 years have already delivered continuous positive returns. It is up to you as an optimist or pessimist on how you believe 2022 will pan out for Indian equities.

The last 2 years have taught us that equity markets are completely unpredictable and no one can predict the short to medium trend of equities. No one predicted the sharp fall witnessed in March 2020 as well as no one foretold the subsequent rally in equities from April 2020 to Sep 2021. Below is a table of quotes form some of the greatest investors and economists (some of them Noble laureates) predicting a severe bear market in March 2020 and the market humbled them all.

We believe and have seen firsthand in our investing journey that the only prediction that has always worked is “ Time is the friend of the wonderful company, enemy of the mediocre” by Warren Buffet. Long term investing in high quality businesses has always delivered healthy returns irrespective of market cycles.

The general perception is that the markets are overvalued post the rally since March 2020 but that is incorrect. NIFTY 50 index (a market benchmark) was trading at P/E of 24.11 on 31st Dec 2021. This is very close to the last 10 year median P/E multiple of NIFTY 50 that is 23.34 as can be seen from the chart below:

Actually the rally in 2021 was driven by strong earnings growth and P/E of NIFTY 50 compressed from 38.55 on 1st Jan 2021 to 24.11 on 31st Dec 2021. This is despite the 24% rally in NIFTY 50 because the earnings growth was much higher. We believe earnings of listed Indian businesses will continue to be strong in 2022 and will drive market returns. The table below shows the strong expected earnings growth for FY23:

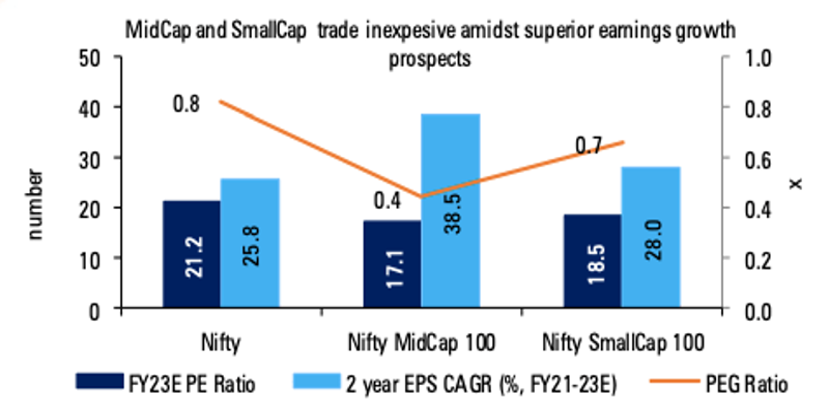

Another common misconception is that smallcap and midcap companies are in a bubble zone as they have rallied more than large cap companies. While it is true that small and mid cap companies have delivered higher returns than large cap companies, it has to be seen in the context of the fact that they have also delivered higher earnings growth and are expected to continue that trend. The chart below compares the 2 year forward (FY23) P/E with expected earnings growth (Bloomberg consensus) of small (represented by NIFTY Smallcap 100), mid (NIFTY Midcap 100) and large cap (NIFTY 50) companies. As can be seen, small and mid cap companies are not trading at higher valuations compared to large caps once the strong earnings growth is factored in.

The rally in Indian equities in 2021 was quite broad with all sectoral indices ending in green as can be seen from table below. However, there was a rotation in sector leadership in terms of returns delivered from 2020 to 2021. Pharma which was the top performing sector in 2020 was the second worst performing sector in 2021. The top 3 performers of 2021 were metals, IT and real estate but metals and real estate had delivered meagre returns in 2020.

IT services continued its dream run delivering 50%+ return for the 2nd consecutive year. This performance is mirrored in the boom that technology is currently witnessing – tech adoption has become a top priority for every industry not only for productivity improvement but basic business continuity since start of Covid-19 pandemic, adoption of digital sales and marketing channels has become a do or die for businesses, talent crunch is severely acute in technology resulting in best ever compensations and high attrition, etc. The rally in commodities and metals in 2021 is being driven by supply chain disruptions due to the pandemic and is resulting in high inflation. Sectors like auto, financial services and FMCG have been underperforming for the last 2 years since the pandemic began. While we believe that the underperformance in FMCG is justified given the very high valuations consumer companies were trading at, auto and financials should perform strongly going ahead. Some of our investing decisions related to this data are:

We believe IT services is in a structural bull run for the next 2-3 years due to the strong demand for digital adoption. We have a healthy allocation to IT services with 2 positions – eClerx and R Systems. Ideally we would have had an even higher allocation to ITS but valuations for most listed IT companies have run up significantly and we are only comfortable with the valuation of these 2 names.

Earnings growth prospects are not as strong or broad based for the pharma sector as for ITS. There are 2 challenges for the Indian pharma sector: One is on the supply side due to its heavy reliance on China for key starting materials and intermediates. The other is the intense competition in generic drug markets especially the US, which is the largest export market for Indian pharma. It is very difficult to make a call on how long it will take to resolve or to even understand the nature of the supply side challenges in China. Similarly, it is very difficult to understand the competitive landscape in the US generics market as well as the regulatory challenges posed by heavy scrutiny by US drug regulator US FDA. So, we have decided to stay away from pharma companies that have a heavy reliance on China inputs and also those that have a very large contribution of business from generics. We continue to be quite bullish about the prospects of companies that derive majority of revenues from Indian branded drugs business because these have the pricing power to pass on input cost inflation and maintain margins as well as are witnessing strong growth in Indian drug demand. So we remain invested in India branded pharma focused companies like Ajanta Pharma, JB Chemicals & Pharma, Alkem, etc. We are also excited about pharma businesses that are very R&D driven and focused on niche and very high value drugs like Natco.

Auto sector has been impacted by multiple factors that are not at all related to demand like multiple lockdowns that impacted auto retailing over the last 2 years, acute supply side shortages in semiconductor chips that has crippled global auto production, etc. In fact, there is a significant pent up demand and order backlog for cars in India as well as globally but OEMs are unable to manufacture to meet that due to the ongoing chip shortage. It is difficult to predict when the global auto chip shortage issue will be resolved but we are still excited about auto components manufacturers that have large export contribution in revenues (like GNA Axles, NRB Bearings) and / or are focusing on developing products for EVs (like FIEM, NRB). We believe globally competitive auto component manufacturers that are focusing on exports as well as tapping the EV opportunity can deliver much higher than industry earnings growth.

Lenders (banks, NBFCs, HFCs, MFIs, etc) have been the biggest laggards in the last 2 years due to valid concerns on impact of the Covid-19 pandemic on asset quality as well as on loan growth. However, we believe that certain pockets like housing finance and retail focused banks will do well due to the strong revival in real estate demand (helping HFCs) and strong retail liability franchise (helping retail focused banks). So, we are quite bullish about the prospect of our investment in IDFC First bank and Can Fin Homes.

Overall, we believe that 2022 will not deliver the very high returns that the last 2 year delivered simply because starting valuations are not that attractive as 2 years back. So, investors need to temper their expectations from 2022 but we do believe that earnings growth will be strong in certain pockets of the economy. 2022 will definitely not witness a broad based rally in Indian equities like last year but with proper stock selection, we believe one can definitely deliver healthy returns and we have our task cut for that.

Please feel free to reach out to us if you have any queries / concerns.

Regards

Prescient Capital

Contact us: https://www.prescientcap.com/contactform