Dear Investor,

Hope you and your loved ones are doing well and are safe from the third wave of the COVID pandemic. Below is a chart depicting the fund performance viz BSE 500 TRI index.

In this memo we will discuss the following:

How the global interest rates and the policy rates in India can affect the capital markets.

Our portfolio’s PE, PEG ratio and the commentary around it.

Why it is a good time to top-up your investments

Section 1: Macros

A lot of you would have read the recent commentary by US Fed Chief Mr. Jerome Powell on the possibility of a rate hike and a reduction in USD liquidity. The same had sent the global markets (Including India) in a nosedive during the last month. While we agree markets are in the rich/expensive multiples territory, we wanted to put some historical perspective to the same. The below chart highlights performance of the US markets and the Indian markets during the last few interest rate cycles.

US market returns during different policy rate cycles:

Indian market returns during different repo rate cycles:

What we can infer from the above data is as follows:

The data indicates that there is no stark difference between returns during the rate hike and rate drop cycles. For India the difference is even more marginal.

Interest rates affect the markets in different ways and the most important of those is triggered by inflation. High inflation for the medium to longer term can suppress demand. In the last 4-5 years, India has seen one of the lowest consumer price inflation when compared to the last decade. As we speak, CPI is rising and may influence policy rates in the near term. Refer CPI chart below:

Inflation also triggers higher lending rates. It has been seen that banks/NBFCs margins expand during a rising rate cycle, which in turn boost their earnings and markets (BFSI is ~ 36% of index). The fallout though is that the CAPEX cycle weakens and can affect the longer-term growth of the Manufacturing/infrastructure sector; something that countries such as India (which have seen a lost decade of CAPEX) cannot afford. We have already seen a big push by GOI on infra/manufacturing and PLI during this budget. Refer to the chart below on Gross Fixed Capital Formation (GFCF) of India which is barely back to pre-covid levels.

We believe that the more dominant driver of returns in the market is the growth in corporate earnings. Markets have come under pressure when growth of corporate earnings do not keep pace with the underlying multiples.

The data below corroborates what we have been discussing in the past memos (Refer November and December 2021 memos here) that growth in corporate earnings are in their best cycle in the last 20 years. The charts below highlight that we are in a cycle similar to the 2003-07 cycle.

Section 2: Portfolio Review

Bottoms up investors like us see the economy from the eyes of the companies we invest in. We find hard working and ethical entrepreneurs that are growing their businesses at >15% CAGR and are available at reasonable valuations. Sometimes the reward of the same is back ended and the journey in between is full of doubts, but time has taught us that real returns are made by investing when a company’s earnings are breaking out, and valuations are cheap. We stick with those companies even at the cost of returns in the 3-9 months but believe that mean reversion would happen. We sell these companies when the business fundamentally changes or the incremental PE to Growth ratio (PEG) is not in our favor. We would like to highlight the same through some of the examples in our portfolio:

* Returns calculated by taking the price of first entry and first exit. Yellow: Exit, Green: Current

Key points to make are:

Our winners have been companies that are run by great founders and were at the cusp of their high growth when we invested. The markets however didn’t price in this growth or was looking elsewhere. This fundamentally created a gap between their reasonable valuation and future growth. Such companies barely move for a while. The wait can extend from 3 to 24 months.

The process however is to have a sharp focus on sustainable growth in earnings and to have some patience.

As you would see some of these companies still have a Price Earning to Growth multiple of less than 1. This implies that their growth/growth potential is still not factored in their valuation. We continue to build our position in such companies.

You would also see we have exited a few companies where the Price Earning to Growth multiple is far greater than 1, implying that the valuation bakes in too much growth which is not coming. We would rather sit out and wait for a correction that hope growth catches up with valuation.

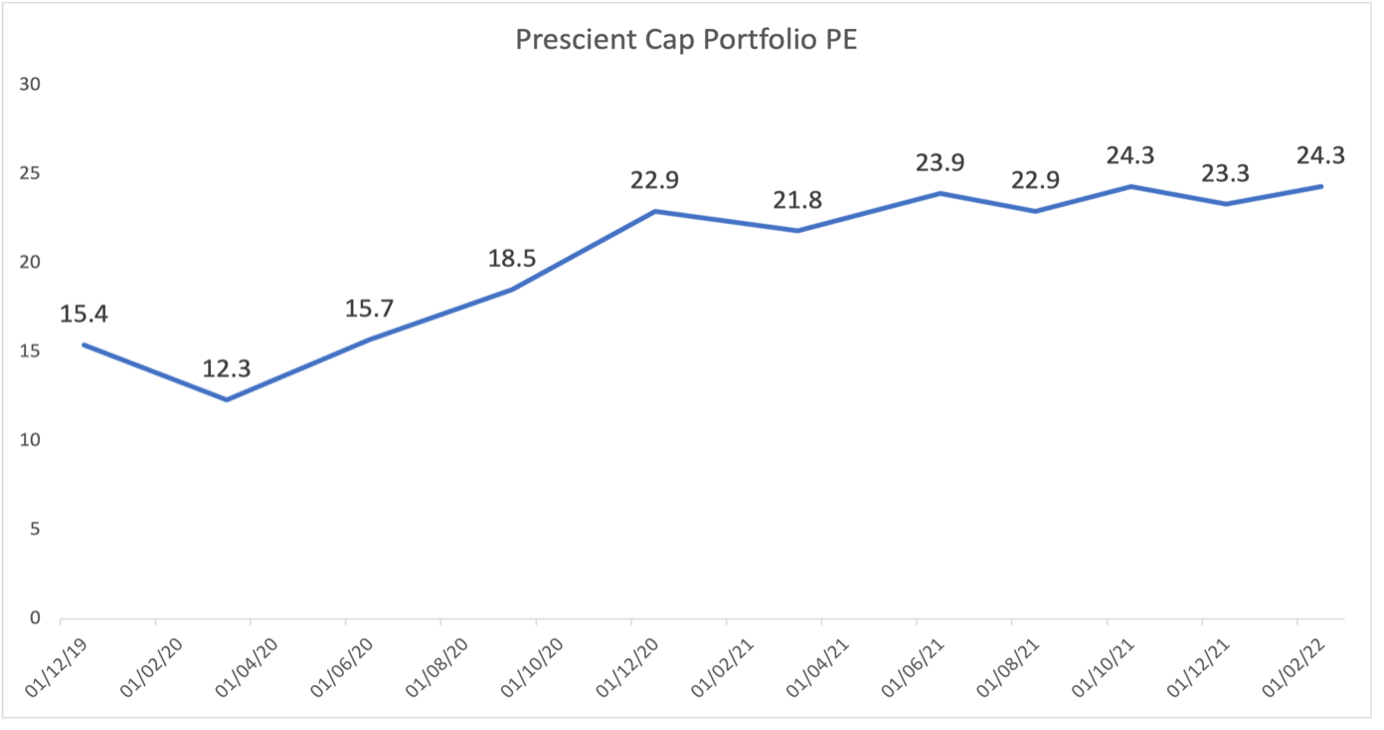

We are still comfortable with our Portfolio’s PE multiple and continue to find opportunities in BFSI, auto ancillaries, IT/ITES and consumer. Refer chart below:

Median PE multiple

Section 3: Time to top up your investments

Based on both our bottoms up and top-down discussed above, we can safely say that this is a good time to top up your investments. The recent and near-term correction in the US/Global markets has nothing to do with the intrinsic growth of Indian companies in general and our portfolio companies in particular. It has made investing in companies we like more compelling. Our portfolio companies are growing well and are available at reasonable valuations. We would want to deploy more capital at this stage and enhance your portfolio returns.

Please feel free to reach out to us if you have any queries / concerns.

Regards

Prescient Capital

Contact us: https://www.prescientcap.com/contactform