Dear Investors,

You are well aware that there has been a sharp and quick global correction in equities since the start of Feb 2022 due to the fear of the impact of the Russia-Ukraine war (charts below) on the global economy. This is very similar to the quick and sharp correction that had happened in March 2020 due to fear of unknown impact of Covid-19 on the global economy. Our portfolios have fallen in line with the correction in benchmark indices and we understand that such a sharp drawdown would be a cause of concern to you.

We write this interim memo to highlight the need for a capital call. We believe that this is one of the best times to deploy more capital in equities in general and with us in particular. We make the argument basis the following points:

Our portfolio’s performance in Q3 remains strong and has no correlation with geo-political conflicts or with US interest rate/US inflation. Our portfolio companies have grown at a YOY sales CAGR of 12%. The earnings growth has been a mixed bag due to cost/wage pressures or fixed marketing/sales burn to support next year's high growth. We remain confident about the earnings performance of the outliers in the portfolio and see them reasonably valued (at a PE to growth ratio of less than one) post this correction. In fact a lion share of our portfolio companies have low correlation with Oil & Gas. Our investments in BFSI, IT, Consumer and Capital Goods have a low correlation with Oil & Gas price. We have been buying these companies off late and would want to allocate more capital behind these names.

The BSE SENSEX has corrected to a PE of ~23x (was around 19x during the Mar 2020 lows) and is fairly valued. On the contrary, we have seen the best growth in the corporate earnings since the last 20 years. Refer charts below. We have covered the same in our Jan 2022 memo (Refer Jan Memo).

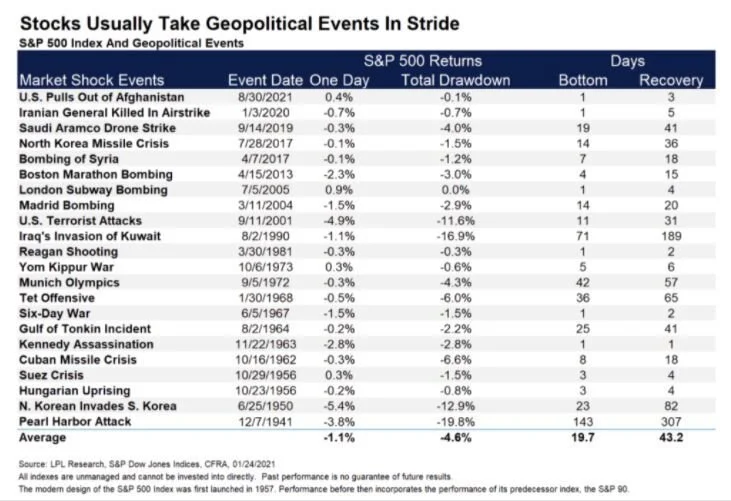

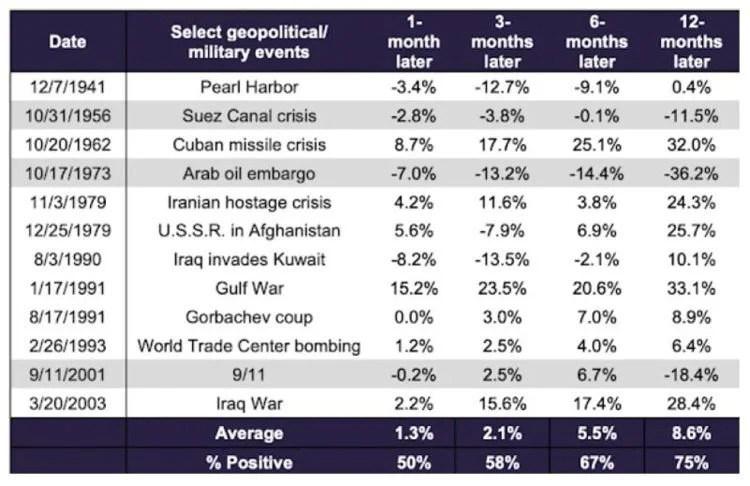

We are not experts in geopolitical conflicts. We however can draw some inferences from the correlation of markets to war. The charts below clearly highlight that markets tend to overreact to geo-political conflicts in the short term and recover well in the medium term. Infact, we believe that the only variable that matters in the end is how strong is the earnings growth.

We feel that the Ukraine war is a much less significant event than Covid-19 that had several social and business impacts like global supply chain disruption, reimagining of workspace, labor migration and great resignation, huge loss of lives, etc. Despite all these pandemic challenges, Indian businesses have fared very well and in fact are in the best of their health in a decade in terms of prospects of exports, leverage on their balance sheet, fiscal support from govt., early signs of capex revival in economy, etc. The main impact of the Ukraine war can be in terms of further inflation in energy prices. However, we believe the current govt. has done a commendable job in maintaining fiscal prudence and should be able to handle the situation relatively well. More importantly, Indian companies have been tackling rising inflation for a few quarters now and we believe fundamentally good businesses will be able to take steps like price hikes, cost control, etc to better handle rising costs.

Just like during COVID-19 pandemic, some sectors and businesses were able to handle the situation well and emerge stronger, this time too different sectors and businesses will be able to better handle the crisis. Hopefully, as your fund manager, we will be able to identify those sectors and businesses that will do well and increase allocation to them.

Lastly, we are not an expert at timing the market however we could see more market correction from hereon. Our plan is to deploy capital judiciously on days of correction and ride out this period. However, if one is invested in quality and durable businesses that can deliver healthy earnings growth over the medium to long term (horizon of at least 2-3 years), then the risk of poor returns or permanent loss of capital is very low or non-existent. Many of our clients run or are in leadership roles in businesses and an important point to ponder is whether they believe their businesses have been impacted deeply by the Russia Ukraine war. It’s just that the price of listed businesses are determined by market sentiments every day that investors feel that their value is so volatile.

We believe that disproportionate returns are made by investing during times of macro-economic pessimism. We believe that we are in the middle of such a period.

Please reach out to us for a detailed/informal discussion. Happy to share our views.

Prescient Capital