Dear Investor,

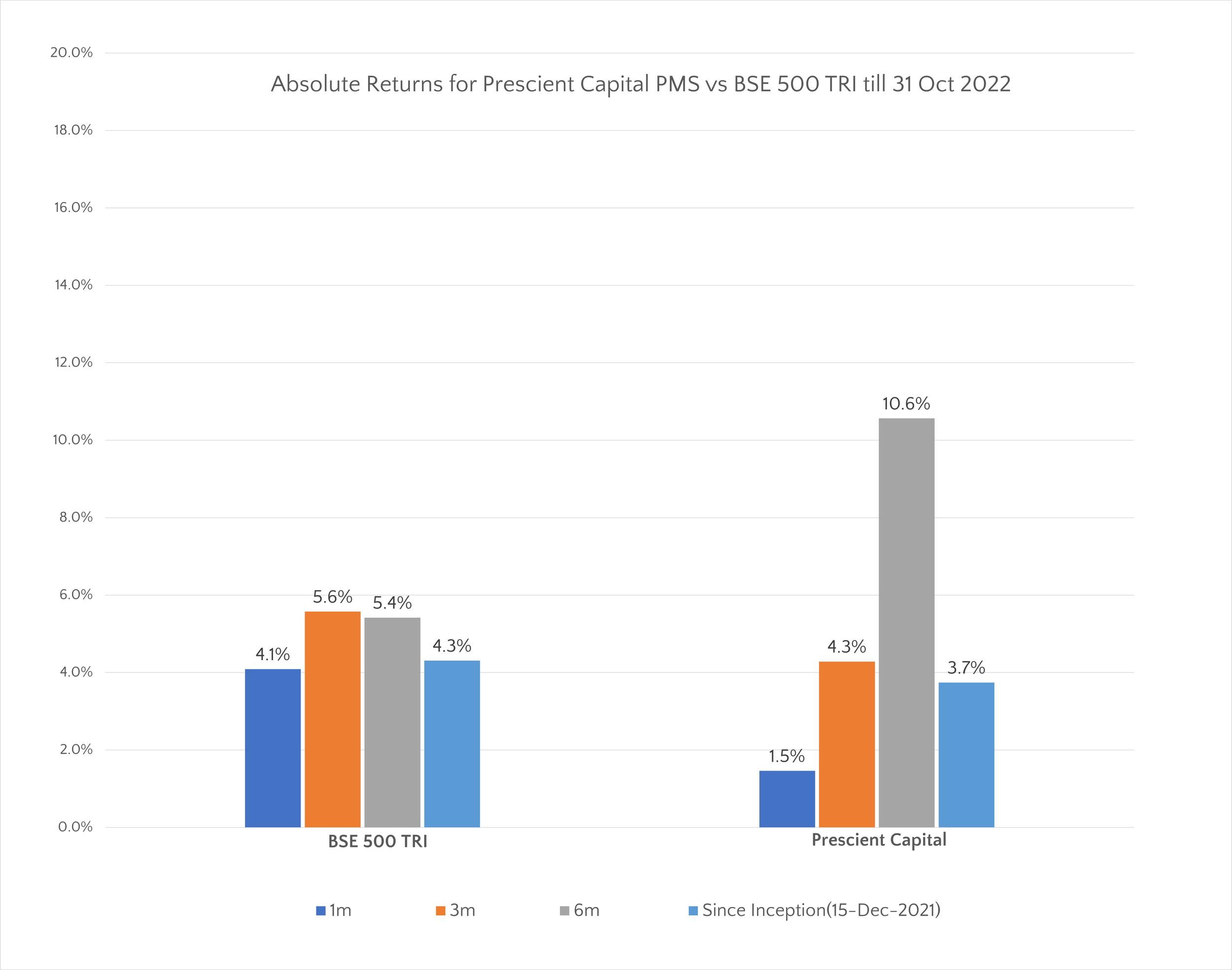

Hope you are doing well. Below is the chart depicting our Portfolio returns viz. BSE 500.

In this month’s memo we compare active and passive investing:

As an investor, a very pertinent question for you to ask is whether it makes sense to just invest in passive strategies, basically index funds, rather than invest in active strategies like us (bottom-up stock picking). This is also an important existential question for us because an active fund management career for us only makes sense if we can beat benchmark indices sustainably. We do believe that sound stock selection can generate significant alpha over long investment horizons in case of Indian equities. However, the belief needs to be supported by some historical analysis so in this update we will evaluate whether an active investing style works in Indian equities or not.

This debate of active vs passive is a hot topic in US equities investing because most active strategies have not beaten benchmark indices like S&P 500 in the last 10-15 years. Given the higher fee structure of active funds, this has led to massive outflow of funds from active strategies into passive index tracking funds in the US. Also, the common perception is that equity investing, especially investing in small cap companies, is very risky and leads to losses. This is highlighted by the graphic below that was part of a recent article in financial daily Mint about the perils of small cap investing. It highlighted the fact that only 12% of small cap companies in India delivered more than 25% CAGR over the past 5 years and 14% of these companies die (get delisted or have trading suspended) over the same period.

Given what has happened in the US and the low probability of hitting upon a multibagger stock idea, one would think active strategies do not deliver alpha in India as well. In India, most of the public market funds are invested in active strategies so it makes sense to check whether historical data supports active investing in case of Indian equities. The table below compares the performance of Indian MFs against relevant benchmark indices over the last 10 years. We have chosen a period of 10 years as equities by nature is a long-term investment tool.

The data above clearly shows that Indian active fund managers have beaten benchmarks handsomely over the last decade. In case of all market cap-based categories of MFs, the median return CAGR is similar or better than the return CAGR delivered by the relevant benchmark index. The top performing fund has comprehensively beaten the benchmark returns while the return CAGR delivered by the top 20th percentile fund has also beaten the benchmark by a decent margin. The outperformance of active fund managers over benchmark is most pronounced in the case of the small cap category. In the small cap category, even the median return CAGR of small cap funds is ~500 bps higher than the return CAGR delivered by the benchmark. So how does one explain the dichotomy between these 2 facts:

Small cap companies have high mortality and low chance of success

Small cap MFs have generated the highest absolute returns as well as the highest alpha on average over the relevant benchmark

Apart from the above issue, another thing to consider is why has active management worked well in India over the past 10-15 years and failed in the US over the same period. We think there are a couple of reasons why active investing, basically stock picking, has worked especially in case of small cap companies in India:

High promoter ownership and lack of activist investors in Indian equities

Indian equities, except those in the banking sector, across market caps have high promoter ownership. This is in stark contrast to US equities in which typically institutions are the majority shareholders. This makes it extremely difficult to replace promoters and take control of the board in case of Indian listed companies. In addition to that, investor activism is low in India, and it is only in the past few years that there have been cases that minority shareholders have rallied together to oppose promoter mismanagement like unreasonably high compensation, totally unrelated diversifications, or acquisitions. There is no active investor in India of the stature of Carl Icahn, Dan Loeb, Paul Singer, etc in Indian investing. The low investor activism in India has both pros and cons for stock picking. On the one hand, there are many cases of obnoxious corporate misgovernance in Indian listed companies, especially mid and small cap companies that have even low institutional ownership. This leads to high mortality or poor returns in these companies, but these can be easily avoided by stock pickers who do a basic due diligence on promoter integrity. While on the other hand, there are many cases of market inefficiencies, again mostly in small and mid-cap companies, resulting in deep undervaluation. These are well run businesses but ridiculously underpriced compared to the value of their underlying assets and investments due to varied reasons like industry downcycle, low institutional interest, etc. In the US, such inefficiencies are quickly exploited by activist investors but in India these persist over considerable time periods. Such opportunities offer patient stock pickers to invest and wait patiently for any trigger to unlock the underlying value.

Business scale needed to get listed in India much lower than in US or China

The scale of business needed for a company to get listed in India has always been much lower than in China or the US. This has historically been the case as there are some ~2,900 companies with revenue of less than 500 Cr (<100 Mn $) out of total ~5,000 listed companies in India (a share of ~60%). The latest company to get listed “Tracxn Technologies Ltd.” had FY22 revenue of INR 63.4 Cr (<10 Mn $). A company of this scale will find it impossible to get listed in the US or China. So, the small scale of most of the listed companies explains the dichotomy in small cap investing that we covered earlier. On one hand, it is natural for many such small businesses to find it very difficult to scale or even survive over time resulting in low probability of small cap companies to be multi baggers. On the other hand, there are many niche small businesses with differentiated models that offer active investors to find venture-like return opportunities with much lower than venture risk. In the small cap space, there are many companies operating in niche areas in industries like pharma, chemicals, consumer, engineering, etc that can scale rapidly just like any tech businesses that are funded by VCs on the private side in India. Below are 2 such examples:

Astral Ltd.

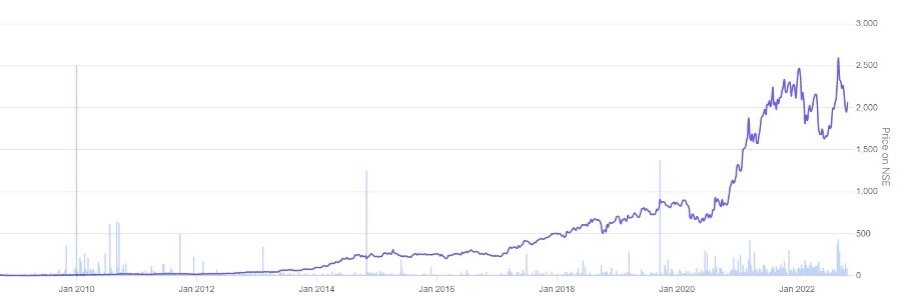

Astral was a small cap company with a market cap of just 219 Cr on 1st Jan 2010 and today its market cap is 41,730 Cr, which is same as that of Paytm today. It has delivered a 191x return over the last ~13 years or so. It is a very differentiated business started by first time entrepreneur Mr. Sandeep Engineer. Astral pioneered the branding of housing plastic (PVC & CPVC) pipes. You might have seen Salman Khan appearing in Astral Pipes ads on TV. No one thought that something as commoditized as plastic pipes could be branded and made into an aspirational product for homeowners. Astral was able to do that over the past 2 decades and the result is its multibillion $ market cap.

P I Industries Ltd.

PI Industries had a market cap of 269 Cr on 1st Jan 2010 and today it has a market cap of 49,506 Cr delivering a return of 184x over this period. PI pioneered the business model of outsourced manufacturing for global agrochemical innovator giants like Bayer, Dow, Syngenta, etc.

There are many more such examples of companies from the small cap space that have scaled up to be multibillion $ market companies. So, there clearly are venture like investment return opportunities in the small cap space in India. However, the risk is much lower than in the venture space because these companies do not have easy access to capital like in the VC space in India. These companies have to use their accrued cash from business to scale, so these companies must be viable / profitable first and then scale using these internal accruals over time. Public market investors like us have the luxury to selectively pick viable and in fact most profitable businesses using simple financial metrics like high ROE / low leverage / lean WC cycle, etc to filter companies. It is relatively easier to cull out poor businesses that will most probably die or generate subpar returns than in venture area where even businesses with multibillion $ valuation are yet to prove their business viability. Thus, the large number of small and mid-cap listed businesses and the associated probability of errors of commission can be minimised by basic research on business fundamentals and management competence. The main analysis that needs to be done is whether these businesses have the right management, processes, business differentiation, etc to scale up and deliver outsized returns. Obviously there will be several cases in which the thesis on growth and scale up may not work out as in the initial investment hypothesis. However, we believe the downside risk of permanent capital loss or subpar returns is much lower in listed small and mid-cap listed space compared to venture capital, but the upside or rewards are almost similar.

The thesis shared above in support of stock selection in Indian equities, especially in the small and mid-cap space, is obviously biased by our strong belief that sound stock selection in Indian equities can lead to alpha generation. This makes sense as we need to be optimistic about the asset class and stock picking that we do and we hope we will be able to deliver healthy absolute returns for our clients.

Thanks

Prescient Capital