Dear Investor,

The last quarter has been a difficult phase for equities, which is also reflected in the drawdown in our portfolio. We believe the market will continue to see a time and probably some price correction in the next 2 quarters. However, we continue to remain optimistic that we are at the start of an earnings cycle that will drive reasonable stock returns over the next 3-5 years. We think any volatility in markets near term will provide us a great opportunity to buy stocks at attractive valuations. In this month’s update, we look at both the negative factors impacting near time performance as well as some of the positives that keep our optimism regarding long term performance of Indian equities intact.

First, we discuss the negative factors:

Impact of US Fed rate hikes

We think in the near term, Fed raising rates remains a significant risk for markets. A normalization of the Fed policy is inevitable and partly priced into markets. However, the medium term impact of a Fed rate hike is dependent on other factors, the key one being India’s GDP growth as well as growth in Indian corporate profits. During 2004-06, Fed hiked rates 17 times by 25 bps each. During the same period, Nifty went up 99.1% though the Dow Jones went up only 7.2%. This is because India witnessed strong GDP as well as corporate earnings growth. During the 2015 cycle, which was more sober, Fed hiked rates by 2.25%. Markets went up during this period too with Nifty rising 40.1% and Dow Jones rising 31.4%. However, in both these cycles, the markets corrected initially in the first few months. So, a Fed rate hike independently is not a clear indicator of market correction in the medium to long term.

Impact of Russia-Ukraine war

We have discussed the impact of this war in a previous update and continue to believe that military conflicts do not adversely impact returns beyond a year based on historical evidence. We cannot add any new insights to multiple geopolitical perspectives that already exist on this subject but agree that the conflict is reinforcing the inflation fears with commodity prices spiking due to sanctions on Russia. We believe inflation was a concern even before this war started and currently also there are equally impactful factors like the Covid lockdowns in China resulting in a spike in inflation.

Impact of Inflation

We consider inflation to be the biggest risk to equity returns in the near term. Other factors like Fed rate hike, reduction in Fed balance sheet, fear of recession in US and slower growth in India, etc are consequences or responses to rising inflation. Inflation in the USA currently at 8.5% is at its highest since 1982. The Fed rate at that time hit a high of more than 10% compared to the 0.25-0.50% currently. Hence, even with a slightly lower inflation, we may continue to see multiple Fed rate increases though possibly at a slower pace. Inflation will impact profitability of Indian businesses, including our investments, in the current quarter (Q4FY22) as well as next one (Q1FY23). Companies including ones in our portfolio have been taking price hikes, though with a lag, to pass on the input and energy inflation depending on their purchasing power. However, we acknowledge that inflation will remain a challenge over next few quarters and will hopefully ease off during the later part of FY23 when Covid situation improves in China and with a possible resolution to supply side bottlenecks in energy. As discussed with some of you in recent interactions, we are cautious about impact of inflation on our portfolio positions and monitoring 2 key factors to better handle impact of inflation on portfolio performance:

Firstly, we are tracking sectors/companies that can take price hikes (IT services, pharma, consumer) to pass on input inflation without adversely impacting demand or maybe are even benefiting from inflation (agrochemicals). We have decent allocation in each and will even increase allocation if our expectations are met or exceeded in the current quarter (Q4FY22) performance.

Secondly, we are tracking sectors/companies that are not directly impacted by commodity and energy inflation but will witness revival as Covid related concerns subside (mainly BFSI).

We do have decent exposure to sectors like auto ancillaries, consumer and cement that are getting and will be impacted by rising inflation. In case of auto ancillaries, though the inflation will impact profitability over a few quarters, we believe there should be a strong cyclical revival in demand as auto sales have plummeted to decadal lows in the past few years. Also, all our investments in auto ancillaries are bottoms up stories that benefit from increase in LED auto lighting penetration in EVs, tightening emission norms, increased outsourcing to Indian forging players and NPD for EVs and hybrids. We believe that these company specific tailwinds will help these portfolio companies meaningfully outperform the Indian auto industry over 3 years+ horizon.

Similarly, all our investments in consumer space are bottoms up stories that benefit from the growth in demand for housing/building materials increased penetration of organized players in packaged food, and segmentation of demand in wellness products. Though demand may be impacted in the consumer space due to multiple price hikes taken by companies, we believe our portfolio of consumer companies will deliver higher than industry growth as they have used this time to expand from a regional player to a national player.

Cement is one industry where we are cautious because it is mostly severely impacted by energy inflation (fuel & power and freight costs is roughly 40-45% of revenue). Our thesis of investing in cement is based on strong demand revival in residential real estate after a decade-long slump and high infra spending by govt. Also, we were enthused by the continued pricing power demonstrated by the industry, driven by significant consolidation, during the last 2-2.5 years. However, the recent hikes in price of crude (> 100$), coal (increase of 100%+ yoy as well as shortage situation), etc have made it impossible for the sector to take price hikes to pass on input inflation. So, the earnings will be impacted over next few quarters, but we believe the sharp correction in cement stocks have more than factored in these factors. We continue to remain optimistic about the medium to long term performance of the Indian cement sector because strong demand drivers remain intact and expect the industry to further consolidate. Overall, we will monitor the inflation situation and will rejig the portfolio based on the above-mentioned performance indicators.

We feel that negative macro factors have been widely covered in recent times. However, there are India specific positive macro factors that we highlight below. At some level, long term equity investing needs us to be optimistic about medium to long term prospects and the below indicators offer hope in these difficult times.

Banking System NPAs bottoming out

Revival in the credit cycle is crucial to sustaining strong economic growth. During the last decade, credit growth was hampered by the ballooning bad debt of Indian lenders. However, the sector has cleaned up bad debts in the last 3-4 years and NPAs are set to bottom out to a decadal low by FY24 as highlighted in a research report by brokerage Motilal Oswal (MOSL). This should support a strong revival in credit growth and help support India’s growth over next few years.

Revival in corporate earnings and CAPEX cycle

Earnings growth was 32% yoy in the Dec 2021 quarter (Q3FY22) for the broader Indian market. Due to the impact of COVID in Dec 2020, it makes more sense to compare Dec 2021 quarter earnings and Dec 2019 quarter earnings. Growth in earnings in this period for the broader market was 120%. Even after excluding financials, the earnings growth for the broader market was 79%. Earnings for mid-caps grew faster than large-caps and small-caps earnings grew fastest. The strong earnings growth is of course also helped in manifold jump in earnings of commodity companies like refiners, petrochemical manufacturers, metals, mining, paper, cotton yarn makers, etc. That might be a cyclical factor, but it does help other sectors like capital goods, engineering, construction, etc immensely as these commodity companies are the largest capex spenders in the economy. After almost a decade, these sectors have the healthiest balance sheet and near full utilization levels and have thus announced huge capex plans over the next few years. This article highlights the same -

Though, we don’t invest in commodities (except cement), this capex drive will help sectors of our interest like capital goods, engineering, building materials, etc.

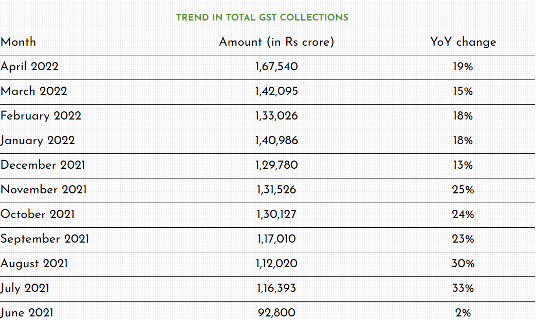

GST collections have been rising m-o-m again indicating good health of Indian corporates

Monthly GST collection hit an all time high in April 2022 and have remained above the key level of 1 lakh Cr / month since July 2021. Q1FY22 (mainly May and June 2021) were impacted by the second wave of Covid but since then GST collections have been higher on a yoy basis every month. A portion of this growth is due to stricter tax compliance and stronger anti-evasion measures but that does not explain the entire increase. Strong economic revival has also resulted in this growth in GST collections. Not only GST, overall tax revenues for Indian govt. have increased sharply in FY22 beating the govt.’s own estimates repeatedly -

This is a big positive as it helps govt.’s ability to spend on infra as well as several PLI (Production linked incentives) schemes it has announced for multiple sectors.

Revival in residential real estate

After a decade long slump, there are early signs of revival in urban real estate demand helped by decadal low home loan rates, need for larger houses due to trend of wfh (work from home) and reduction in supply demand mismatch –

Real estate is a key sector of the economy as construction is one of the biggest employers and it is also a big demand driver for building materials and other ancillary sectors. Also, when real estate does well, it has a big wealth effect and improves overall consumer sentiment. If the real estate revival sustains, it will be a big positive for Indian economic revival.

To summarise, we are cautious about the near term (next 6-9 months) performance of Indian equities and believe this will be a volatile phase with limited upside, if any, but we continue to remain positive about the long-term prospects. Unprecedented inflation is a key risk challenging corporate profitability so we will keep monitoring its impact on our portfolio positions and rejig the portfolio accordingly.

Prescient Capital