Dear Investors,

Hope you and your dear ones are doing well.

Below is our newsletter for the month of April 2021:

This is a very difficult time for all of us as we face the biggest crisis of our lifetime. The Covid-19 crisis is a generation defining crisis for us just like partition, war, famines, etc would have been for our previous generations. We sincerely hope that all of us are able to navigate this challenge successfully and emerge unscathed. Even though the crisis is taking a big mental toll, all of us are trying to carry out our responsibilities as best as we can. As an investment adviser, that for us means working to deliver the best investment outcomes for our clients during this challenging phase. In order to do that, we are trying to gauge the impact of this brutal second wave of Covid-19 pandemic on Indian equities and managing the risks to our portfolio as well as possible.

Overall our sense is that this time Indian equities should not correct to the same magnitude and as quickly as it did in March last year because of couple of factors:

We have seen that equity markets correct sharply and irrationally when there is sudden emergence of a risk whose impact is unknown. If a risk is relatively well understood, then the reaction is generally not that severe. Unlike in March 2020, when the business impact of the Covid-19 pandemic was not clear at all and equities globally reacted with the sharpest and quickest fall in decades, this time the market has seen the impact of the crisis on businesses in FY21. So, the risks from this second Covid-19 wave is relatively much better understood by investors compared to last year and it is highly unlikely that there will be a knee jerk and widespread correction in equities this time. This is already evident from the fact that since the onset of the second wave in late March this year, Indian equities have been volatile but have not witnessed meaningful correction till date.

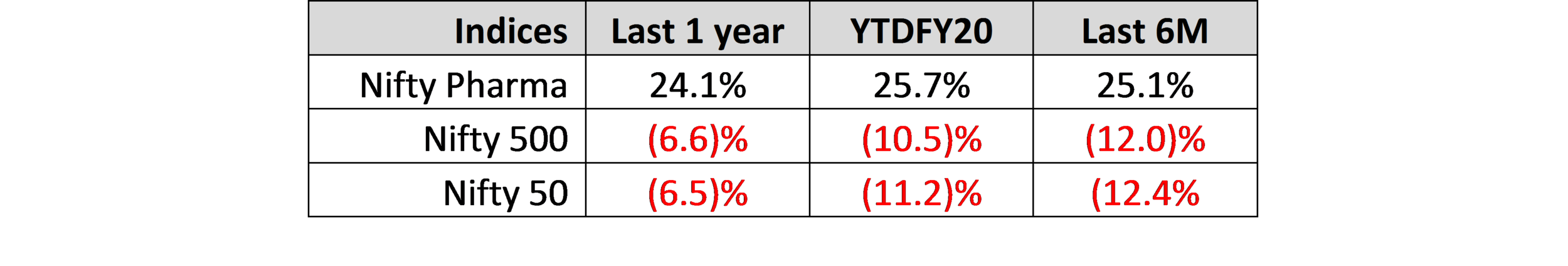

It is clear from the last time that just like any crisis, the impact of Covid-19 crisis is not uniform on all industries. In fact, this crisis has even created unexpected opportunities in many sectors. There are few sectors like travel & hospitality, retail, media, movie theatres, etc that were and will continue to be severely impacted. On the other hand, there are several other sectors like insurance, pharma, IT, metals & commodities, etc that have actually benefited from the crisis. Most other sectors like banking, auto, consumer durables, cement & building materials, engineering, agri inputs, etc did not witness any significant earnings impact in FY21 because of the crisis. These sectors were seriously impacted in Q1FY21 (April-June 2020) due to the imposition of the nationwide lockdown. However, these bounced back very quickly from Q2FY21 itself and few sectors like auto, consumer durables actually enjoyed significant growth due to release of pent up demand in the rest of the quarters last financial year post Q1. Thus leading companies in these sectors ended FY21 with minimal degrowth as is clear from the sales data of leading auto companies below. Even within the auto industry, it was one of the best years for tractors because the rural economy remained healthy and resilient last year due to lower incidences of Covid-19, strong support by government policies and normal monsoon.

So, it is rational to believe that the second wave of Covid-19 crisis will have a different impact on different industries as was the case last year. Travel & hospitality, retail, aviation, etc, which were beginning to show some signs of recovery in H2FY21, will again suffer significant business loss. Our expectation is that select companies in pharma, ITS, etc will witness some benefits. For example, now that Indian drug regulators are approving vaccines for Covid-19, some pharma companies like Dr Reddys, Cadila, etc that have Covid-19 vaccines in their portfolio will see meaningful earnings from this vaccination opportunity. However, the same sector and companies will not witness identical impact as last time because circumstances in this second wave may be different. For example, we don’t believe agri plays like fertilizers, agrochemicals and tractors will witness the same tailwinds as last time as the pandemic’s impact in this second wave is much more widespread and tier 2/3 cities as well as rural areas have been much more impacted this time compared to last year. It is precisely our job as your advisor to identify sectors / businesses that will do well and also those that will suffer significantly due to this second wave and make investment decisions accordingly.

It is abundantly clear that the central govt. as well as most state governments clearly do not want to impose months long stringent nationwide lockdown like last time. Several states starting with Maharashtra and followed by Delhi, UP, Karnataka, Haryana, Bihar, etc have imposed localized lockdowns / restrictions of varying intensity this time. However, manufacturing or construction activities have not been banned anywhere like it was during Q1 of last financial year. All states have come up with standard operating guidelines for these and the common feedback from ground is that even local authorities are not interfering arbitrarily with manufacturing or construction activities. Moreover, this time till date there has not been a mass migration of labour like last time. Even though there may be specific instances of some factories being shut down temporarily due to spread of Covid-19 among workers, there is no blanket shutdown of plants and factories this time. So, if conditions deteriorate meaningfully from here on, there is a chance that a highly restrictive nationwide lockdown is imposed like last year but our sense is that the government will only do it as a last option.

Most of the economic indicators till end of April have not shown any meaningful deterioration:

o Monthly GST collection was at an all-time high in April 2021 (https://www.business-standard.com/article/economy-policy/gst-revenue-collected-in-april-2021-is-at-a-record-high-of-rs-1-41-trn-121050100471_1.html )

o Manufacturing has held up in April despite the onset of second wave and local lockdowns (https://timesofindia.indiatimes.com/business/india-business/manufacturing-activity-steady-in-april-despite-covid/articleshow/82380158.cms )

o Both exports and imports picked up significantly in April this year. Since manufacturing was completely shut down in April 2020, so a y-o-y comparison is not correct but April exports were higher even compared to April 2019 (https://www.thehindubusinessline.com/economy/indias-exports-in-april-rise-197-per-cent-with-growth-across-sectors/article34462983.ece ). Exports growth is expected to remain strong as several international markets like the US, UK, Asia, etc are now out of the Covid crisis and witnessing strong economic rebound.

o Both IMD and Skymet have forecasted a normal monsoon this year which is a relief for India’s agri economy.

o Metals, especially steel, are witnessing the best pricing as well as capacity utilization in over a decade. The pricing and utilization levels of Indian steel industry is further expected to improve due to Chinese policy actions like removal of export incentives on steel, curbs on export of specialized steel alloys as well as intense environmental clampdown on highly polluting steel plants, etc. The improving business prospects of the steel industry will have a significant trickle down effect on other areas of Indian economy like power equipment, engineering goods and consumables, power consumption, etc. This is because it is expected that a phase of substantial capex in Indian steel industry will begin due to the onset of the current upcycle. Steel sector is one of the biggest capex spenders in a manufacturing economy. So, the upsurge in metals should have a substantial positive impact on manufacturing especially engineering & capital goods.

The impact of the Covid-19 crisis on large organized Indian businesses across industries has been much less compared to MSMEs and the unorganized players. Due to strength of their balance sheets, large scale, significantly better management quality, etc most sector leaders in industries that have a large share of unorganized segment were able to wrest away market share from unorganized players in FY21. So, even though the Covid-19 crisis has led to large scale unemployment, severe stress for India’s MSME sector, MFIs, small NBFCs, etc the impact has been nowhere as brutal on listed sector leaders across industries and leading listed banks / NBFCs. Below are a few examples of such listed companies:

Lastly, investors have seen the massive rally in equities from the bottom of last March and are well aware that even if businesses get impacted for a few quarters, they will eventually bounce back and in fact are much well prepared to handle this challenge compared to last time. So we believe that whenever there is a meaningful correction of like 10%, investors would rush into buy into equities providing support to the market

In summary, our assessment is that Indian equity market will not suffer a drawdown as large and especially as quick as the last time but it will definitely remain volatile as long as the Covid-19 crisis persists and even witness 5-10% correction on inflow of any unexpectedly bad news. We will request all our investors to remain calm and not lose faith in equities during such short phases of correction. Also, we believe that markets would undergo time correction due to current levels of relatively high valuation in several pockets and one should expect a much muted market return in FY22 compared to FY21. Moreover, it is highly likely that there will be subsequent waves of Covid-19 pandemic until 60-70% of Indian population is immunized and herd immunity is possibly achieved. So, Indian businesses and equities may be facing a long period of uncertain and challenging environment and our job as your advisor is to manage your investments well through this phase.

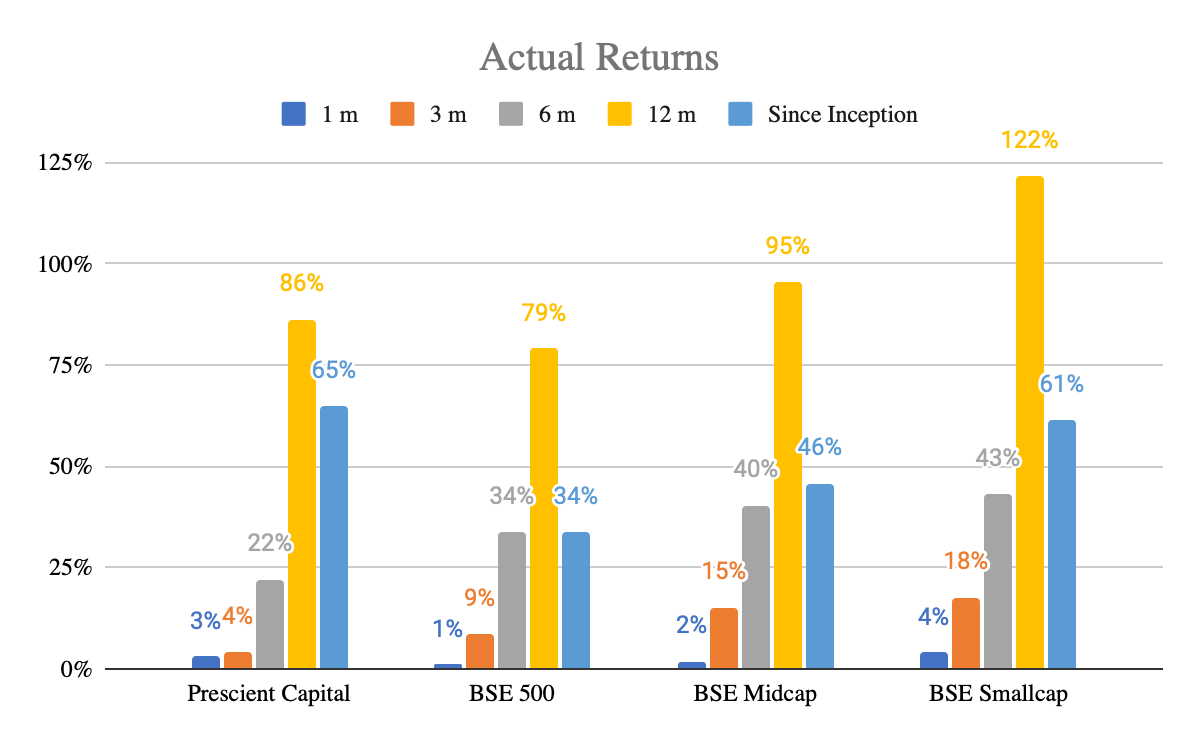

Given this phase will most probably be a long and volatile one, this is a much more difficult task compared to last year when the markets recovered from the lows in March very quickly and then witnessed an unidirectional rise over the next 7-8 months. Obviously we have our task cut out this year but we believe that our strategy of investing in quality businesses with good earnings prospects at attractive valuations should help us deliver better than market returns in the medium to long term. We will continue to focus on keenly tracking the impact of the Covid-19 crisis on our portfolio companies and rebalance the portfolio to increase allocation to positions that are less impacted or can even possibly benefit from some opportunities thrown up by the crisis while exiting positions that are materially impacted by the crisis. We will of course also be on lookout for new investment ideas that will do well despite the challenge of the Covid-19 crisis. We might miss some opportunities like we did even last year but we believe if we stick to our time tested strategy of patiently investing in quality businesses run by competent and honest management, we should be able to do a good job for our investors.

Hope you all stay safe and healthy and please feel free to reach out to us in case of any queries / concerns.

Regards

Sonal / Anubhav

Prescient Capital