Dear Reader,

Hope you and your family are doing well in these testing times.

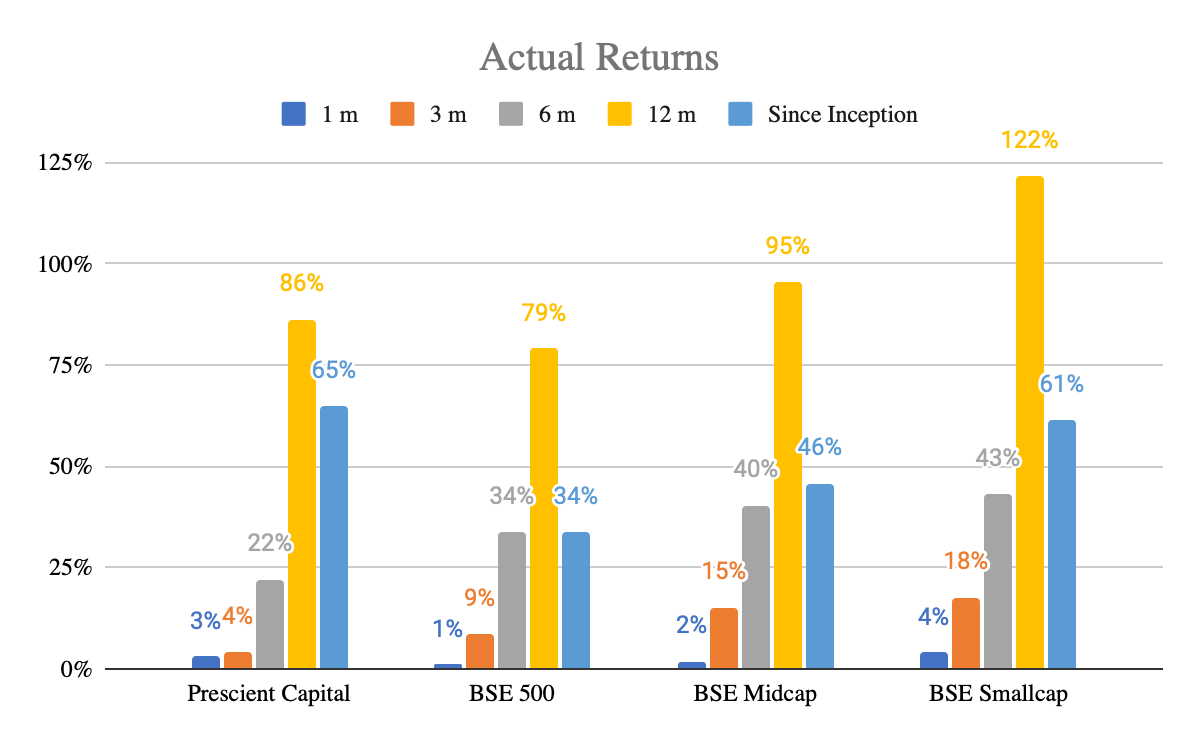

Below is a chart detailing our performance viz major indices:

The last one year has been an unpredictable roller-coaster to say the least. In this investor update we wanted to do an annual review of the markets, the underlying sectors and how behavioural biases played a role in shaping the returns the markets have delivered.

One Year Review

The lockdown came into effect on March 23, 2020 and led to a correction of ~35% in the broader indices. Zoom out one year, the index is up by ~100% from its lows and by ~25% from its pre-lockdown peak values. During the peak of the lockdown, we heard narratives ranging from a 25-40% contraction in GDP, to a 2-3% mortality of the Indian population due to the COVID-19 pandemic. Some experts forecasted a complete collapse of real estate, auto and the travel sectors. While we are not delving into whether the government did a great or a poor job of managing the pandemic, we surely wanted to write about why some of the biases and perceptions were wrong and the economic impact of the pandemic was far less in comparison to what was estimated by analysts.

During phase 1 of the lockdown, the impact of the pandemic spread was restricted to Tier 1 cities. The Semi Urban and Rural India did not see a significant spread of the pandemic. Apart from disruption in movement of migrant labor, COVID did not impact the crop sowing and production. India saw its 5th successive year of record harvest of wheat/rice (up at a CAGR of 4% for the last 5 year) during this period. As a result, the sales of Agri inputs (3 year growth CAGR of 14%) , tractors (yoy sales growth of 20%), 2 Wheelers (yoy down by only 3%) saw a sharp rebound.

As countries around the world wanted to de-risk and beef up their drug supply chains during H1 of FY 21, exports of both the formulations (up 18% yoy) and the API (up 9% yoy) saw a sharp upswing in demand.

The lockdown also caused a disruption in the organized and unorganized labor force during its peak (24% unemployment rate in April 2020). The impact however lasted for 3-4 months as a strong demand rebound in auto, chemicals, pharma and IT led to a revival in demand for the workforce. The unemployment rate in March 2021 is lower than its pre COVID value in Feb 2020 (at 6.5% compared to 7.7%).

Almost all of the listed companies saw their overheads (rent, travel, power) come down by 5-15%. A benign raw material pricing further created a cash cushion. This created surplus cash for the companies and reduced the pressure on wages.

During the lockdown, people saved on discretionary products and services. It is estimated that domestic savings went up to 21.4% of GDP in Q1 FY 21, when compared to 7.9% in Q1 FY 20. This savings formed the base for spending in the subsequent quarters.

We had seen a growth of passenger vehicles in China post the opening of the lockdown, as people found it safer to travel in their own vehicles than shared mobility solutions. India followed the same journey as higher savings and lower cost of funding helped people buy new vehicles. If we consider the two months of the lockdown where people could not buy cars, passenger vehicle sales is down by only 3%.

Between March and August 2020, the RBI imposed a moratorium on both principal and the interest payments due during the same period. They also rolled out extra lines of credit for the MSME and the unorganized companies with a good credit history. Markets initially feared that the moratorium period will permanently alter consumer behaviour and the NPAs in the banking sector could be between 10-30%. As we see the situation right now, and at the cost of not overly generalizing the argument, banks/nbfcs that had prudent lending and collection practices pre-covid, have come out stronger post-covid. Their peak NPAs are expected to be in the range of 2-5% and they have gained a significant market share.

During the same period, the Indian economy also consolidated its fiscal and monetary position. The forex and gold reserves of the country have been up by 22% and 5% yoy respectively. This has helped stabilize the INR. The GST collected is seeing a sharp uptrend and has been down only by 7% (given the economy contracted by 25% in Q1 FY 21).

Markets & Portfolio Deployment Update

As equity fund managers, we wear the hat of an optimist when the world around is a pessimist, and a pessimist when the world around is an optimist. During the peak of covid, we tried to be an optimist and continued to invest in sectors where growth hadn't been hampered by COVID. In all honesty, while we could forecast and invest in companies/sectors whose businesses were resilient to COVID (in the IT, Pharma, BFSI and Chemicals), we lagged in fully understanding the revival in auto, consumer durables, metals and capital goods.

The table below shows sector returns and growth during the COVID period. We have taken the BSE/NSE sector indices and companies constituting the index as a proxy for the growth in the sector and the returns delivered.

Key observations from the above are:

We prefer to invest in sectors with a positive demand outlook. If you look at the chart above, we have invested in sectors (Pharma, IT, BFSI, FMCG) where the demand has been robust or is least impacted by COVID.

We do not understand some sectors (metals, real estate). They have delivered 30% and 10% returns in the last two months, compared to 8% for the broader index. These sectors typically have a low ROE/ROCE profile and are highly cyclical in nature.

Our medium to long term buy and hold strategy generally requires patience over a 1-2 year period, hence switching between sectors and companies to follow a momentum in stock price is tough for us.

We continue to focus on sales/ earnings growth and quality of earnings and believe that the same is a leading indicator of sustainable wealth creation.

April 2021 Onward Lockdowns

We have been keenly monitoring the ramp-up of the second wave of COVID-19. The ramp up has caught the healthcare infrastructure providers and pharma companies by surprise and hence lockdows have been the best counters. While the situation on the ground is changing rapidly, we do not believe that this government can bear the economic impact of one more complete lockdown. From the investing perspective, any uncertainty in this regard will and have led to a correction in the markets. Headline indices are down by 2-3%. From a portfolio perspective, we continue to deploy capital in sectors that are least impacted by COVID. Our incremental deployment has been in Auto, IT and Consumer staples.

On the portfolio front, we continue to be cautious in our capital deployment and have created reasonable cash reserves in both old and new accounts. We continue to exit companies where valuation has hit top quartiles and the trade off between growth and valuation is not in our favour. Over the course of the next 2-3 months, you will see us exit more such companies in our portfolio. The cash generated will be redeployed gradually into new ideas.