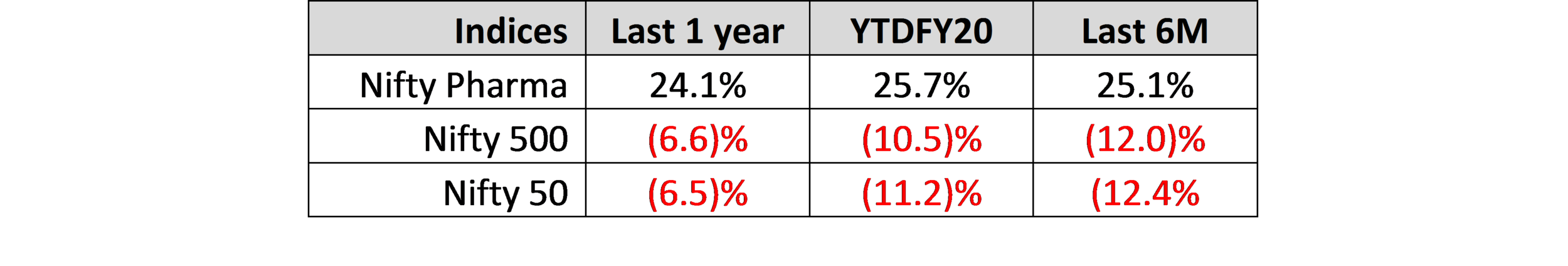

If you track Indian equities, you would be aware that the pharma sector has outperformed the broader markets as well as benchmark indices like NIFTY50 in the last few months. The table below compares the performance of the pharma sector represented by NIFTY Pharma index against the main index NIFTY 50 and the more broader index NIFTY 500:

This outperformance has been driven by few factors. The most important one is that demand for drugs has not been hampered in medium to long term because of the Covid-19 crisis. In fact, Covid-19 pandemic being a healthcare crisis has only increased the demand for affordable drugs both in India and globally. There was a slight disruption in drug demand in the domestic pharma market in April and May as patients couldn’t go for doctor consultations during the nationwide lockdown. However, the demand improved drastically in June when the country started to unlock as is shown below:

SOURCE: IQVIA

Moreover, India being one of the largest exporter of generic drugs globally has stepped up to its role of being the world’s pharmacy during this Covid-19 crisis. There has been a surge in global demand of drugs like HCQS, Azithromycin, Paracetamol, etc, after it was found that these might be effective in treating Covid-19. Indian pharma companies like IPCA, Cadila, Alembic Pharma, Granules India, etc, which are one of the largest manufacturers of these drugs globally, were able to meet this increased demand and thus witnessed good growth in their exports. Covid-19 has also thrown up new product opportunities for Indian pharma companies. Some have collaborated with MNC innovator pharma firms to manufacture and sell their novel drugs for Covid-19 in India and other emerging countries. Some are even working to come up with their own novel drugs or vaccines for Covid-19.

So it has become apparent that the impact of the Covid-19 pandemic will be minimal on the pharma sector. In fact, the crisis has benefited select Indian pharma companies by presenting new business opportunities. Compared to this, the impact of Covid-19 is much more structural and pronounced on other sectors like travel & hospitality, movie theatres, consumer durables, auto, NBFCs, etc. Due to superior prospects of the pharma sector, investor money has flown into pharma companies partially driven by reallocation from other sectors. This has resulted in recent appreciation of share prices of pharma companies and has driven the current outperformance of the pharma sector.

However, an important question is whether the pharma sector can deliver further gains from this point on? Specially given that prices of most pharma companies have appreciated considerably so is there room for further upside. Also, is Covid-19 crisis the only factor driving pharma outperformance? If that’s the case then the performance of pharma sector from here on should be in line with or even below market as the economic impact of Covid-19 starts waning. We believe that the outperformance of the pharma sector during this Covid-19 crisis is just the beginning of a long term bull run for the sector. We see several tailwinds for the sector that can help it deliver good returns over the next 2-3 years.

However in order to understand the medium to long tailwinds for the pharma sector, one will need to look at how the pharma sector has done in the past 4-5 years. The pharma sector has performed well recently but if we look at a longer time frame then it underwent a phase of substantial correction over 2015 to 2019. The underperformance of pharma is even more stark if we compare it against the performance of another sector like financial services over this period. This is highlighted by the charts of NIFTY Pharma and NIFTY financial services below:

This correction over 2015-19 was driven by the poor business performance of pharma companies during this phase. This was due to a couple of factors impacting different business segments of pharma firms. Firstly, the Indian pharma market was impacted by the implementation of GST in 2018 because GST led to pharma channel disruption for a long time as pharma wholesalers and retailers reduced their inventories. In FY18, the domestic sales growth for pharma companies slowed down considerably and the impact on profitability was even higher as typically the domestic business is the most profitable segment for Indian pharma companies.

Secondly, exports to US for several Indian pharma companies was impacted over 2015-19 due to increased scrutiny from US drug regulator called FDA (Food and Drug Administration). US is the largest export market for Indian pharma and exports of generic drugs from India to US had been growing considerably. Prior to ~2015, US FDA officials would come down from US to inspect Indian pharma plants and companies would be intimated well in advance about any upcoming inspections. So, companies would have the time to prepare the plants so that these could meet US FDA standards during such inspections. However, from ~2014-15 US FDA began increasing its local presence in India with several FDA officials settling down here. These inspectors started conducting surprise inspections at Indian pharma plants dedicated for manufacturing and supplying drugs to US. They would show up completely announced at plants so companies wouldn’t get time to spruce up their facilities at last moment. Moreover, the number of inspections conducted as well as the scrutiny of the inspections both increased drastically as shown in the chart below:

Most Indian pharma companies at that time did not have the manufacturing standards to comply with this increased scrutiny by US FDA. As a result, FDA either banned exports completely from few firms like IPCA, Wockhardht, etc or stopped any new product approvals from the non-compliant plants of others like Dr Reddys, Sun, etc. This severely impacted US exports for several companies leading to poor earnings performance over FY15-19 because US generics is typically a large segment contributing anywhere between 30 to 50% of sales and net profit. The table below mentions few pharma companies that were flagged by US FDA for not adhering to its manufacturing standards during 2015-2019:

Lastly, emerging markets in Latin America, Asia, Africa, etc which are also large drugs export destinations of Indian pharma companies were also impacted by general economic slowdown and currency depreciation. So, almost all key business segments for most Indian pharma companies were impacted due to different factors leading to poor business and consequently poor share price performance over 2015-19. There was a loss of investor confidence in the sector, which is best reflected in the falling contribution of pharma sector to the main benchmark index NIFTY 50. As shown in the chart below, the share of pharma sector in NIFTY 50 fell from 5.23% in Mar-2014 to just 2.42% in Mar-19 compared to an increase from 27.45% to 38.85% for financial services sector during the same period.

However, the prospects for the pharma sector started improving around a year back due to a confluence of factors. Firstly, Indian pharma companies worked on improving their manufacturing standards for US exports over the last 3-4 years. They put in place the necessary processes, automation as well as trained their workforce to ensure compliance with US FDA regulations. All these efforts bore fruit as most of the Indian pharma companies, whose plants were deemed non-compliant by US FDA during 2015-19, were able to regain regulatory clearance from FDA in the last 1 year. The US FDA itself acknowledged that the quality standards of Indian pharma plants dedicated to US generics have improved drastically. Also, the Covid-19 crisis has been an impetus for US FDA to increase the pace of clearing such plants in order to ensure sufficient supplies of essential drugs as has been covered here and here. Moreover, there have been several instances of drug shortages in US, especially injectables, over last 3-4 years even before the onset of the Covid-19 pandemic in March 2020. The Covid-19 crisis has just been a tipping point that has prompted US FDA to support the growth of India’s generic exports to US. In fact, prompt clearance of Indian plants has become a priority for US FDA as it looks at alternative ways to inspect them even during the Covid-19 crisis as physical inspections are not possible.

The much improved culture of regulatory compliance at Indian pharma plants as well as the supportive stance of US FDA are a big positive for India pharma’s prospects for US generic exports. Being one of the largest business segment for Indian pharma, US generics should drive strong earnings performance for the sector over the next 2-3 years at least. Similar to the US business, the prospects of the domestic business has also improved drastically over the last 2 years. The impact of GST on the domestic pharma market has waned and the market has grown a healthy double digit of 11% in FY20. The Covid-19 crisis has further added an impetus to the domestic pharma market growth as spend of Indian govt. on healthcare and purchase of drugs is expected to increase manifold. Driven by all these tailwinds, the pharma sector should deliver strong earnings growth over next 3-4 years.

This high earnings should translate into higher than market average returns for the pharma sector over the next few years. This is also because the pharma sector is trading well below its long term historical median P/E valuation. As can be seen in the chart below, NIFTY pharma is currently trading at a P/E of 31.2 that is at a substantial discount of 28% from its long term historical median P/E of 43.2.

Many people believe that the Indian equity market is expensive currently as it has pulled back substantially from the bottom formed in mid March when the markets corrected sharply due to fear of unknown business impact of Covid-19. This belief is well supported by the fact that NIFTY 50 is currently trading well above its long term historical median P/E multiple. As can be seen in the chart below, NIFTY 50 is currently trading at a P/E of 27.9 that is at a substantial premium of 29% from its long term historical median P/E of 21.7.

So, it is very stark that the NIFTY pharma is trading at 28% discount to its long term median valuation even though its prospect amid this Covid-19 crisis is much better than that of the broader market, which is clearly overvalued, as is evident in NIFTY 50 trading at 29% premium to its long term median valuation. We believe that the undervaluation in NIFTY Pharma will correct in the medium term especially driven by the fact that pharma sector will do well while the broader markets will take 1-2 years to revert to pre-Covid level earnings. This is because other sectors like financial services, auto, travel & hospitality, consumer durables, real estate & construction will take long time to recover. We have strong conviction that outperformance of pharma sector during the current Covid-19 crisis is just the beginning of a long term bull run for the sector driven by reasonable sector valuation and multiple business tailwinds for the sector.