Dear Investors,

The following chart depicts our returns viz BSE 500 TRI:

As we close FY 24, we wanted to pen down our last 4 years at running Prescient Capital; our investment journey, track record, investment framework, and how should one go about selecting a public market fund. We are sharing a link below to our corporate video. Hope you like it and could share the same in your network.

Link: https://www.youtube.com/watch?v=IWrABowp3yM

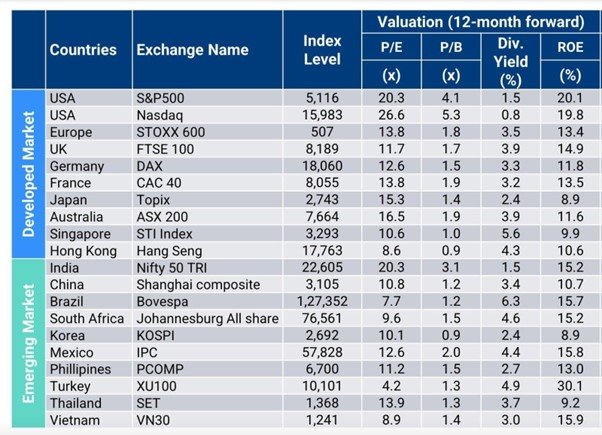

In this month’s update, we will share some general musings on the market. Firstly, we look at the valuations of different equity markets around the world. The table below shows the FY25E valuations of key benchmark equity indices of different markets:

Source: Bloomberg

Some of the key inferences from the above table are:

NASDAQ (US tech) is the most expensive key benchmark index in the world mainly because of the rally in the top 7 tech stocks (called magnificent 7) that are considered big beneficiaries of the AI boom like Nvidia.

Indian large cap indices (as represented by NIFTY 50) are reasonably valued with a 1 year forward valuation of 20.3. However, the same cannot be said about Indian mid cap (defined as listed companies with rankings of 101-250 on basis of market cap) and small cap (defined as listed companies with rankings above 250 on basis of market cap) companies, whose valuation we will discuss later in the update.

Most emerging market and European equities are quite cheap, so India and US markets have been clear outperformers since 2020.

A cut in US Fed rates may trigger a rally in global equities but it may not have the same effect for Indian equities, especially broader Indian markets, given already elevated valuations of Indian small and mid-cap companies.

Indian small and mid-cap companies have witnessed a sea change in the past ~25 years as seen in the table below. The average market cap of a mid-cap company today is almost the same as that of a large cap company 10 years back while the average market cap of a small-cap company today is almost same as that of a large cap company 25 years back. So, we feel that investing should not be bracketed based on market capitalization as there are enough good small and mid-cap companies that can grow to have large capitalization over time. Obviously, the mortality rate of small businesses is high so the trick is to identify great business and management quality to ensure that one’s investments can survive business cycles to grow big.

The chart below shows the valuation of Indian large, small and mid-cap companies as represented by their respective benchmark indices. As of April 2024 end, the small cap index was trading at the largest premium to its historical average

The above graphs give the impression that mid and small-cap companies are outrageously overvalued and we need to sell these immediately. However, the actual picture is more nuanced because though small stocks are expensive, these have delivered the best earnings growth in the last few years as can be seen below.

The table below shows the last 3 years and last 5 years returns of different sectors as represented by its benchmark index. Clearly, several sectors like industrial, capital goods, power, defence, real estate, etc, which have delivered the best returns in the last few years, have mainly small and mid-cap companies. On the other hand, the biggest laggards like banks and large cap IT have the biggest weights in large cap benchmark indices like Nifty 50. Banks (SBI, HDFC, Kotak, ICICI, etc) have a combined weight of more than 30% in NIFTY while large cap ITS (Infosys, TCS, etc) have a weightage of more than 10% in NIFTY. On the other hand, sectors like power, cap goods, industrials, etc don’t even have a combined weight of 5% in NIFTY while these constitute more than 25-30% of small and mid-cap listed universe.

So, the bottom line is that though small and mid-cap companies are expensive currently, the rally in these stocks was driven by strong earnings growth over the last 3-5 years in certain sectors. Our strategy is a small and mid-cap strategy, so it has naturally benefited from tailwinds in industries like manufacturing, cap goods, building materials, etc. Till now, we had fair representation of sectors like cap goods (TD Power Systems, Voltamp transformers, Kirloskar Oil engines, etc), auto ancillaries (FIEM industries, Gabriel, GNA Axles, NRB Bearings, etc), cement (JK Lakshmi, etc). When we invested in these ideas a few years back, these were available at very attractive valuations. The manufacturing revival in India since 2020 has resulted in strong earnings growth and substantial improvement in financial metrics for all these names and these have generated good returns for us.

However, we acknowledge that some of these names have now become expensive but still have good earnings prospects. So, we are exiting these in a calibrated manner and rotating into industries that have been laggard till now and are available at reasonable valuations like financial services, pharma, etc. Overall, we are mindful of elevated market valuations and are investing cautiously.

Please feel free to reach out if you have any questions.

Regards,

Prescient Capital