Dear Investor,

Below chart depicts our returns viz BSE 500.

In this month’s update, we will look at how Indian manufacturing is doing. We have a large allocation to manufacturing (auto & auto ancillaries, engineering & capital goods, chemicals, etc) in our portfolio. Manufacturing, especially engineering & capital goods sector, has done very well in the last 2 years. It is the most important sector for generating employment and driving higher GDP growth. All the Asian miracles of the last century like Japan, Korea, China, Taiwan, etc have attained high employment rates and prosperity through manufacturing and exporting for the world.

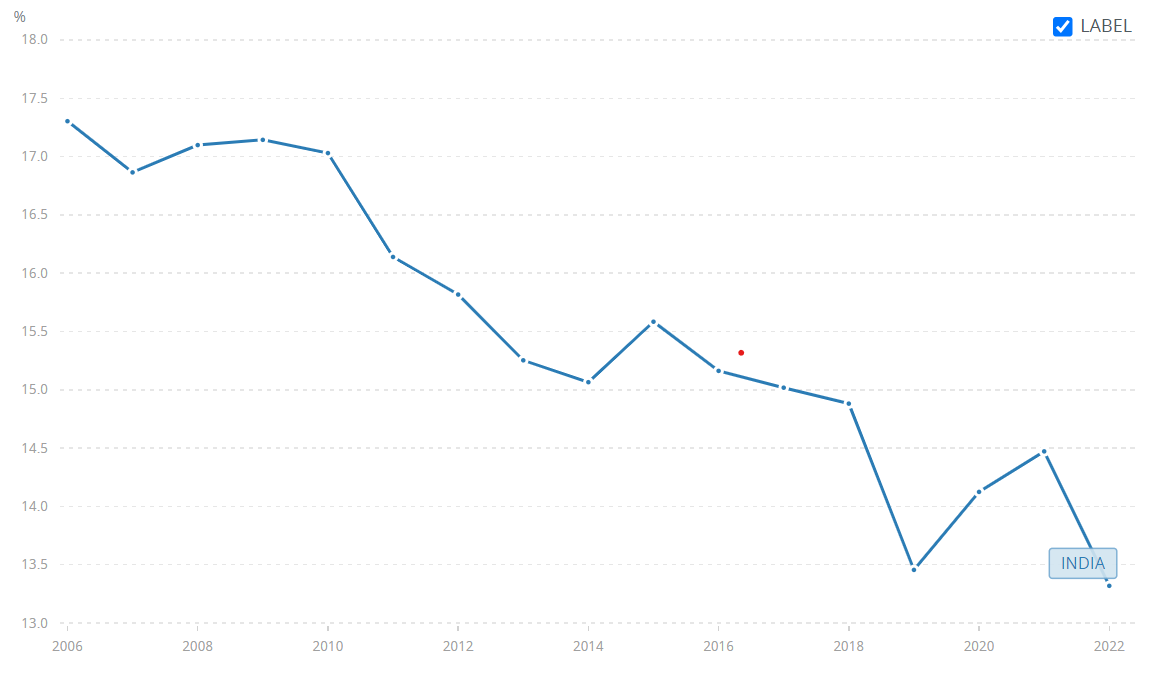

In the last 15 years, the share of manufacturing in India’s GDP has continuously fallen as India’s GDP growth has been driven entirely by growth in services. However, services can neither generate enough employment for the millions of Indians entering the workforce every year nor uplift the majority of Indian forced to work in the agri sector because of lack of decent employment opportunities.

Source: World Bank

The contribution of manufacturing to India’s GDP at ~13% is much lower than the 20-28% for much more prosperous Asian economies like China, Japan, Korea, Malaysia, Thailand, etc. Just as contrast, countries like Vietnam and Bangladesh have done much better than India in growing their manufacturing sector during the same period.

Despite India’s much touted low labour costs, India’s rank in global exports is quite low. The same can be explained by low labour productivity, poor infra & logistics, lack of trade agreements with most of the developed economies, etc.

Source: IMF

However, since FY21, manufacturing, especially engineering and capital goods, companies have shown strong growth. In the last 5 years, the govt. has implemented several measures like lowering corporate tax rates, especially for new established manufacturing companies, Production Linked Incentives (PLI) schemes for several sectors, subsidies for electric vehicle manufacturing as well as negotiating trade agreements with Europe, UK, Australia, etc. There has been a sharp rebound in the Index of Industrial Production in the last 2 years.

In fact, global manufacturing is going through a challenging phase currently as interest rate hikes by most central banks have taken a toll on economic outlook and prospects for manufacturing are bleak for most economies. India is the only country where manufacturing PMI has been expanding every month since June 22.

The commentaries of managements of most of the manufacturing (engineering & capital goods, auto ancillary, etc) companies in the recent earnings call have also been very positive in the last 5-6 quarters. We believe this is the strongest guidance /commentary we have witnessed manufacturing companies give in the last decade or so. There is an upbeat tone and confidence to become a global leader in their respective components in these management commentaries. We have shared below snippets of comments by managements of manufacturing companies including those by some of our portfolio companies like KOEL, TD Power, MM Forgings, FIEM, etc:

________________________________________________________________________

Company: Cummins India

Products manufactured: Engines

Management commentary:

Q4FY23 Call:

So, what we have endeavoured to and what we have been saying for the last couple of years is our ambitions as a company are to grow at twice the GDP and to continue to attempt to increase our profitability by 100 basis points year- on-year.

As far as segments are concerned, the segments I have continued to mention in my previous two calls such as data centre, infrastructure, hospitality, hotels, and now we have been manufacturing, continue to remain very, very strong. We are seeing even commercial and residential realty start to slowly bounce back and get stronger. So, when I look across segments, I am continuing to see in proportion to the growth of the GDP the segments continuing to hold. So, all those segments which are contributing to the growth of GDP are contributing to demand for us. So, that's the way I am looking at it.

Company: Kirloskar Oil Engines (KOEL)

Products manufactured: Engines

Management commentary:

Q4FY23 Call:

A little less than a year ago, we started a journey of 2X-3Y. We said that core as an organization will grow 2x in 3 years. With that strategy in place, we started working on a major business transformation effort. The transition is still a work in progress.

Company: Steel Strip Wheels

Products manufactured: Steel & alloy wheels

Management commentary:

Q1FY24 Call:

Analyst: Hi, thanks for the opportunity and good afternoon to everyone. Sir, my question is on your exports. I have two questions. So first one is on, if I look at your global, maybe global players who are in the same business, can you please tell us how different are our segments compared to let’s say Maxion Wheels or Ronal Group in Europe?

Management: So our wheels are not different. They’re absolutely not different. They are the same.

Analyst: So then in that case, for example, Ronal Group, the average realization per wheel is about you know, INR5,500 to INR6,000?

Management: That is in EUR. Again, the exchange rate makes a difference, plus the cost is higher in Europe…

Analyst: Sir, I am only talking about INR terms. So I know...

Management: So you convert that in INR, what exchange rate? You converted that by INR95, INR90, it all varies. And secondly, aluminum prices are much different in Europe, than in India. And the cost structure in Europe is much higher than it is in India. So you cannot say that, the same thing, it's like buying a McDonald's in India versus buying a McDonald's in America. It is not the same.

Analyst: Right, so then my subsequent question to this is, if I look at their cost structures, maybe if I focus on employee cost only, in percentages terms, they are paying almost double the percentage that we pay. So we in India are…

Management: That’s the advantage, absolute advantage, yes.

Analyst: So can you please talk more about it and tell us maybe in the future, your growth will be much higher because this arbitrage is there and therefore...

Management: I said in the beginning of the call that I am looking at 10 million wheels predicated on the fact that. I will be the lowest cost producer of wheels in the world with the quality amongst the top five vendors of the world. There is nothing new in this to add.

Company: MM Forge

Products manufactured: Forged parts mainly for auto sector

Management commentary:

Q4FY23 Call: We are looking at almost close to 25% growth vis-à-vis 72,000. We are looking at close to 90,000 MT for FY24 and with exports being stable. We are continuing to focus considerably on the domestic market, and we see a lot of traction over there.

Company: FIEM Industries

Products manufactured: Lights for auto sector

Management commentary:

Q4FY23 Call: Analyst: And sir, could you tell us how this would ramp up in the next 2, 3 years? We are talking about adding 3 new models of Yamaha and also starting with Hero. So if you could tell us how it will shape up in FY '24 -'25? New order...

Management: So specific numbers, we won't be able to give you. But overall direction, we are giving you the new customers that have been added and specifically with regards to Hero and the EV segment, which are new. Basically, we are very bullish on that.

Analyst: Okay. So we expect to outperform the industry by 10%, 15% in the next 2, 3 years?

Management: Yes. That we have always maintained that we will outperform the industry given our diversified mix that outperformance, we are pretty confident.

Company: TD Power

Products manufactured: Generators

Management commentary:

Q4FY23 Call: Management: We have seen a huge jump in the order book in this segment on a year-on-year basis up about 55%. Orders have increased both from the domestic market as well as export market across the board. The domestic market is seeing a big revival in capex, and we are seeing demand broadly across all sectors. In the export market, we're seeing the same factors playing out as we have been discussing in the past few quarters. Macro factors continue to drive the business, move to renewables, waste to heat energy, garbage burning plants, etc.

Analyst: I had a follow-on question that you guided for the 20% volume value growth for FY '24. Now given where the cycle is, do you think this kind of growth can be sustained in the medium term, say, 3 to 5 years?

Management: No, that's a good question, and I don't want to be overly optimistic in saying that this kind of growth will be sustainable. So -- but as far as our company is concerned, we have a strategy to sustain the growth based on diversification of products and diversification of markets. So today, we see order increases taking place by 38% and 48%. That kind of a sustainable -- that kind of a huge growth may not be -- it may flatten to about 20%, 25%. This is my expectation.

________________________________________________________________________

We continue to be optimistic about the performance of Indian manufacturing going forward. There are very early signs that Indian manufacturers are focusing on becoming globally competitive and on increasing their market share of global exports. Over the 2012-21, Indian manufacturing was in a deep down cycle during which manufacturing companies with outstanding managements focused on improving their capabilities by developing new products, establishing credibility in international markets, building relationships with foreign buyers, lowering their cost structures, preserving their balance sheets, etc.

We now believe such outstanding Indian companies are poised to benefit from the double benefits of revival in the Indian capex cycle as well as the focus of developed economies like US, Europe, Australia, etc to diversify their vendor base from being acutely China specific. We are cautious and aware that the Indian capex revival is in early phase, and it is difficult to predict how long it can sustain. So, we will be tracking the sector and our portfolio companies from this sector closely, but we repeat that we are optimistic considering the current demand environment and prospects for the sector.

Please feel free to reply if you have any queries / concerns.

Thanks & Regards

Prescient Capital