Dear Investors,

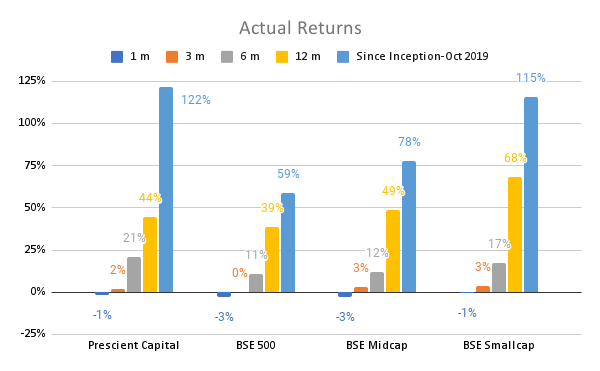

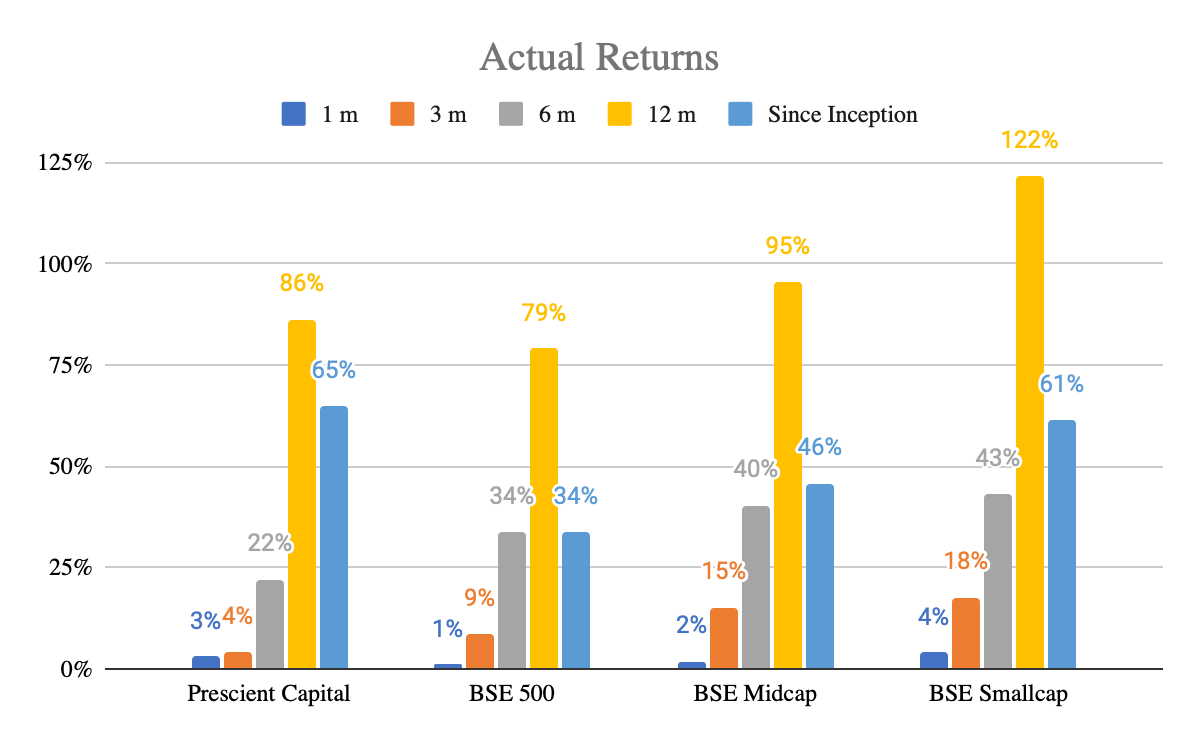

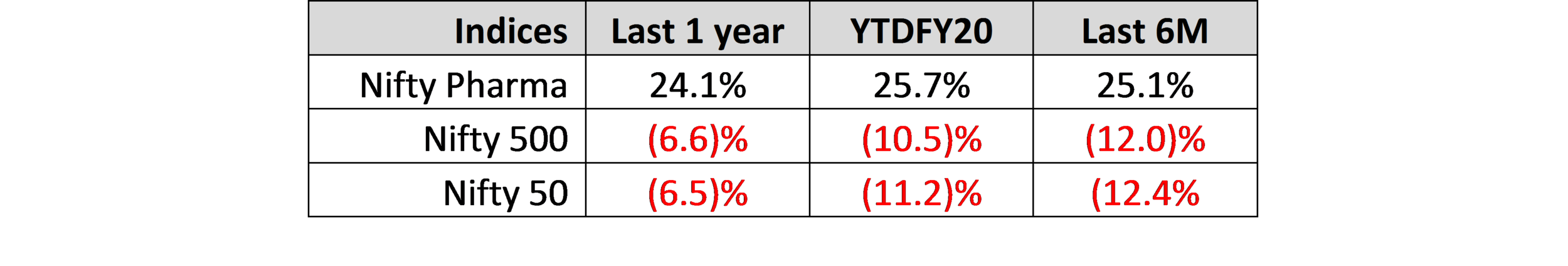

Hope you are doing well. Below is the chart depicting our fund returns viz index.

When to Exit?

This month we wanted to discuss our framework on when to exit a stock. Many of you have discussed with us the timing of our exits when the markets have peaked in the background.

We believe that exit is the most difficult skill a fund manager masters. Needless to say, we have got the same wrong too, at times. What makes things difficult is the emotional cost of staying invested in a stock. It has the ability to colour our decision making.

We therefore write down our exit conditions when we get in any company or stock and always track the company against that exit condition. This three-point exit framework helps us stay unbiased/unemotional about our exits:

Exit at any price if we discover any material and credible red flag on the corporate governance, capital misallocation of the promoters.

If there is any change in assumption on the quality/governance of the promoter, it is best to exit the stock. We have often seen that rich valuations of a stock are supported by a belief in the managements’ ability and their fair treatment of minority shareholders. This trust is often built over years. We have seen time and again examples (Yes bank, DHFL, RBL, Manpasand, Capacite Infra) where a material red flag on corporate governance can significantly de-rate a stock by as much as 80-90%. It is therefore best to exit a stock when we discover any material and credible red flag.

Red flags around capital misallocation (eg: Exide, Kirloskar Oil, Bajaj Consumer) where a management enters not related businesses is often a sign of an incapable management. We believe that if a management has surplus cash (over and above what it needs to support its business growth) it should distribute the same back with shareholders in the form of dividend/buyback. We may sometimes go wrong in assessing a management’s ability to launch a new business successfully. We however believe that any new business typically takes >5 years to establish, a timeframe which is beyond our investment horizon. For that time, the new business is often a drag on the profitability of the existing business.

We do not like over-acquisitive management for the same reason as given above. It has been proven statistically and operationally that mergers/acquisitions are difficult to execute. Managements who are always acquiring are in a state of flux, which hurts a company’s profitability. We recently exited NAZARA (a gaming company) for the same reason. Their acquisitions in not related categories is a way to buy topline. We also believe that it typically takes 4-5 years for any M&A to fructify in synergies, a period beyond our investment horizon.

Lastly, a management's corporate governance track record once tainted, remains tainted, till there is a change of ownership.

Any material deviation from the stated business/growth plan leads us to reassess the decision to stay invested or allocate more capital to the stock.

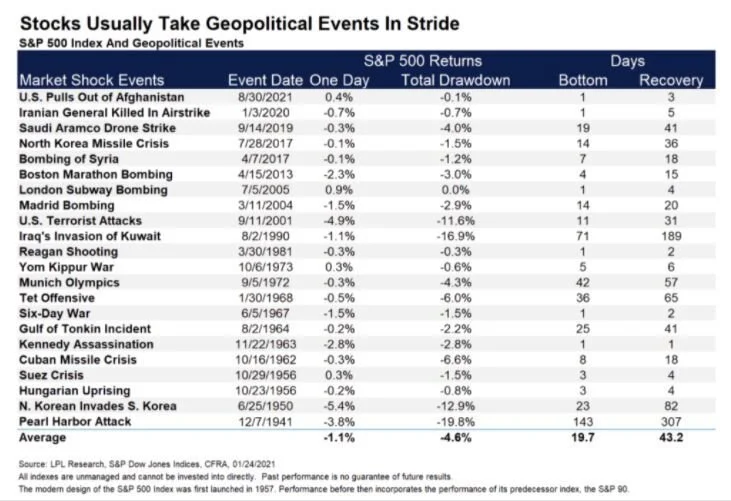

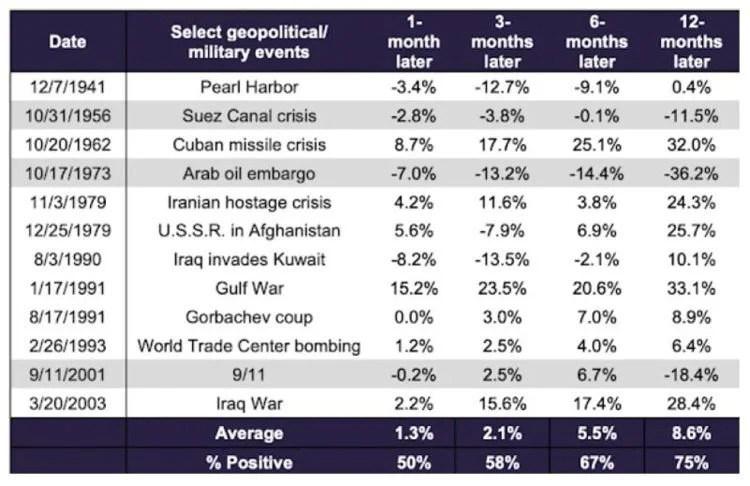

We are usually patient in our approach to assess the execution capability of a management and prefer to have a point of view after 9-12 months of investment. This helps us segregate events that are in the control and that are out of control of a management. We have often seen that markets are more focused on QoQ performance than the plan over 2-3 years. A management might miss its earnings estimate in a quarter due to events that are one time or not in the control of a management (war, supply shock, trade embargo, commodity price spiralling up). This creates a buying opportunity for us, rather than an exit opportunity. On the flip side, if we believe that an event can dent the earnings of a company for more than 12 months, we prefer to exit or trim our position in a phased manner and revisit the company after the 12 month period.

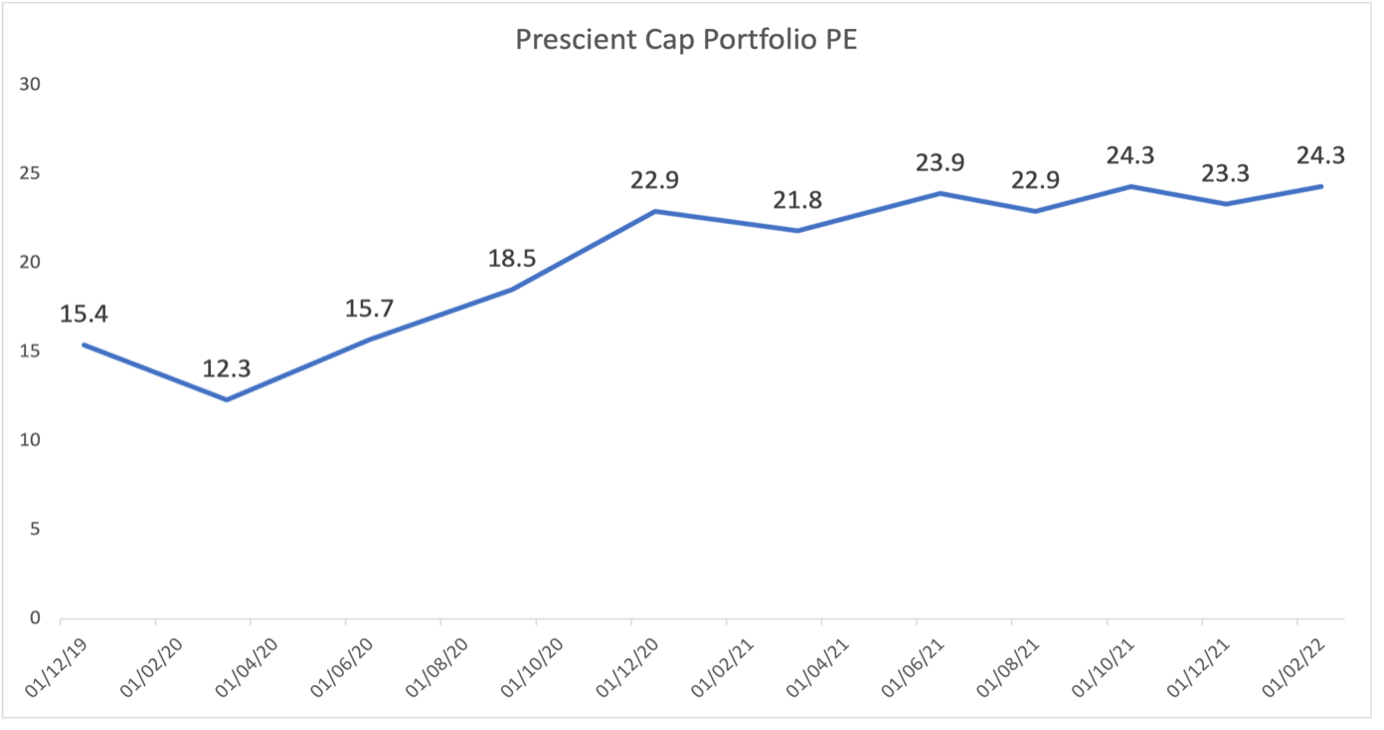

Lastly, we invest at conservative trailing PE multiples and are not too greedy in deciding the exit multiple.

While investing, we define a reasonable exit multiple (typically 70-80% percentile) and stick to the same in exit. For example: In our IT investments, we invested at a PE multiple of 8-12 x in Birlasoft and started exiting the stock at a PE multiple of 30-35x. In Mphasis, we started entering the stock at a PE multiple of 12-15x and exited the stock at a PE multiple of 35-40x. In TD power, we started entering at TTM PE of ~ 8x and have started exiting at a TTM PE of 25-30x. We believe that odds of things going wrong are higher at rich multiples and hence one should re-allocate that capital to ideas where odds of making a sustainable 20-25% IRR are higher.

We would also like to share our recent coverage in Zee business titled: What are five key things to keep in mind for successful long-term investing - Analyst decodes

Thanks

Prescient Capital